Gold is on fire.

The yellow metal is up more than 60% this year. It’s risen nearly 30% in the last 3 months alone.

It’s hard to get a nuanced opinion on gold as a holding. There are a lot of extreme opinions. Some people hate gold and think it’s useless. Some people love gold and think it’s the best protection against government spending, the dollar and the Fed.

I’m not a big fan of going to extremes. I prefer to live in the gray area, not black or white.

I personally don’t own any gold but I understand why some investors have an allocation. Gold is one of the most unique assets there is. It truly marches to its own drummer.

Let’s do a little history lesson on the returns of gold vs. the S&P 500 by decade and then I’ll share why I don’t own any.

Gold went nuts in the 1970s:

One of the biggest reasons gold was up almost 30% per year in the 70s was that Nixon ended the Bretton Woods system that pegged gold to the dollar. Add to that sky-high inflation, oil price shocks, a weak dollar, government spending, and it was like throwing a match in a Jake’s Fireworks store.

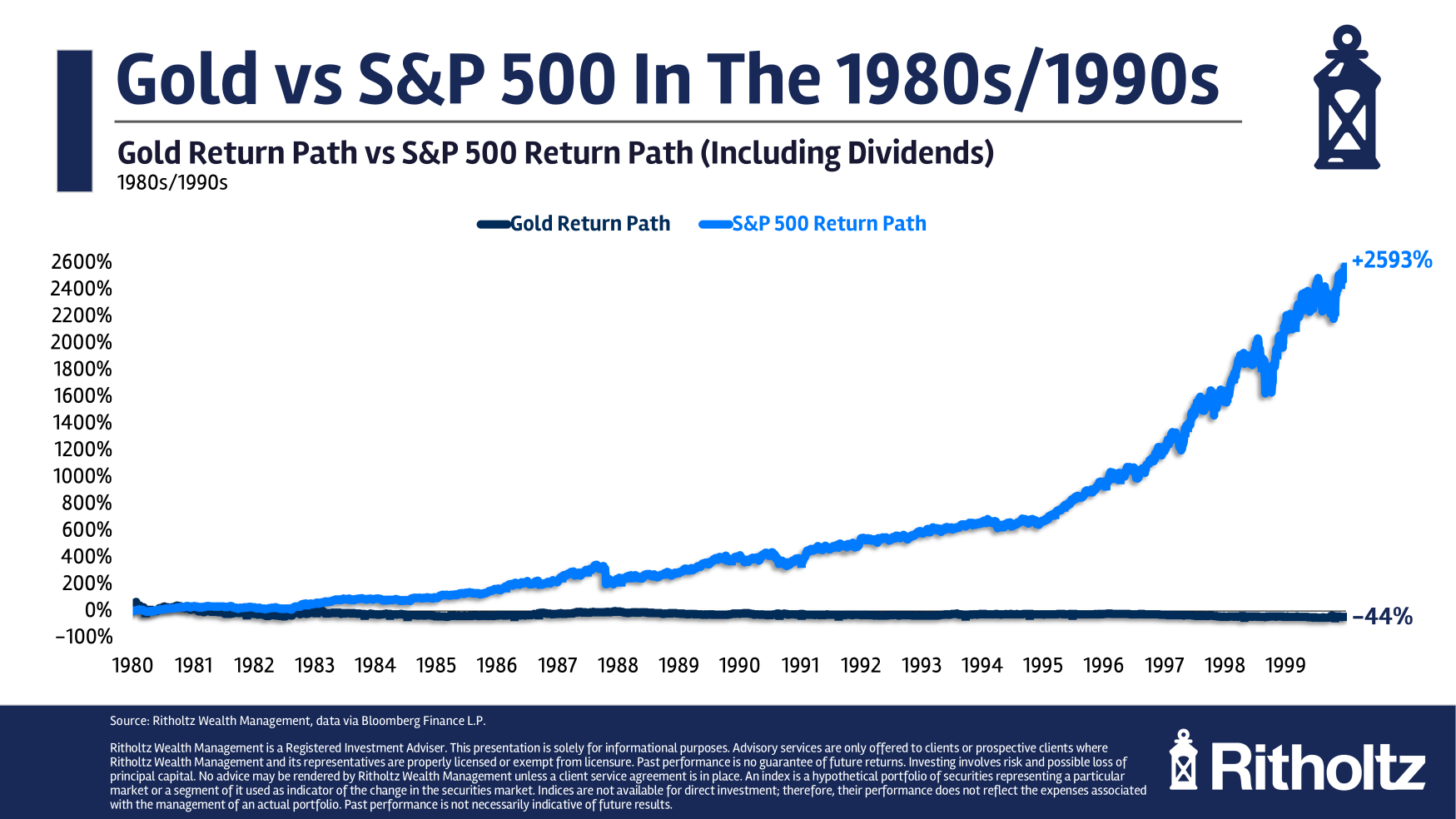

The other side of that insane run-up was a big-time reversal in the 1980s as stocks went nuts and gold got crushed:

That continued in the 1990s:

Gold had a max drawdown of nearly 70% and a negative return for 20 years. On an inflation-adjusted basis, gold didn’t pass the high from the early-1980s until last year.

It was a long rough patch.

Then just when everyone had given up on gold as an asset class, there was a lost decade for the S&P 500 in the 2000s while gold had a big recovery:

Gold shined and proved itself once again to be a good hedge against financial crises. The advent of GLD as an ETF in 2004 surely played a role here. For the first time ever investors had an easy way to buy gold that didn’t require storing it somewhere themselves.

By the summer of 2011, GLD had briefly surpassed SPY in terms of assets under management. It wouldn’t last. That was the peak for quite some time as gold went on to have a rough decade:

Gold was up a little more than 3% per year versus a return of almost 14% annually for U.S. stocks in the 2010s.

In the 2020s gold and the S&P 500 are both booming, with gold taking off like a rocket ship in recent months:

Gold is a pretty good diversifier, especially during tough decades for stocks. It’s also been used as a form of currency or asset for thousands of years. That history has to be worth something.

So why don’t I own any gold?

Part of it is the fact that it’s not a productive asset. It doesn’t do anything — no earnings or cash flow.

Part of it is I’m big on innovation and gold seems like a relic to me. If I had to choose I think Bitcoin, which I do own, makes more sense going forward.

But I think it boils down to the historical return profile. I know stocks go through booms, busts and lost decades but gold went on such a terrible 40-year run that it makes me nervous to hold it for the long run.

Look at the run in the 1980s and 1990s:

Then you had a good decade in the 2000s that was more or less followed by yet another lost decade in the 2010s.

From 1980 through year-end 2019, these were the total returns for gold and the S&P 500:

- Gold +197%

- S&P 500 +8,242%

So you’re looking at annual returns of 2.8% versus 11.7% respectively. The worst part is that the annual inflation rate was 3.1%, meaning gold lost money to inflation over a four-decade-long stretch.

Using the same calendar year-end returns going back to 1928, the worst 40-year return for the S&P 500 was 8.5% per year.

Now you could say I’m cherry-picking here. If you include the 1970s, the long-term returns for gold look much better. Since 1970, gold has been up more like 8.5% per year.

I just don’t have the stomach for an asset that has the ability to experience 3 lost decades out of 4.

It would be nice to own some gold when it goes through boom times like 2025 but you have to get used to not always owning the most popular asset each year.

I like being diversified but that doesn’t mean you have to own everything.

I understand why many investors do own gold. It acts as a form of insurance. It has little correlation to any other assets. It’s volatile which makes it a good candidate for rebalancing purposes. I totally understand the appeal.

I even get why some investors think gold matters more now because government around the globe are spending and borrowing so much money while showing no signs of slowing down.

Fair enough.

You always have to be comfortable with what you own and why you own it. The same is true for the investments you don’t own.

Sometimes you have to watch other people own assets that are up 60% in a year and be OK with the fact that you don’t own any.

Avoiding FOMO isn’t always easy but that’s part of your job as an investor sometimes.

To each their own.

Further Reading:

What’s the Investment Case For Gold?