It’s long seemed to me, as a female of the species, that the world of finance tends to be male territory. From Crypto Bros to Wall Street Wolves, the face of finance remains distinctly masculine.

Of course I’m not suggesting that women aren’t in finance and economics – because we are.

But from much of the publicity we get, you’d be forgiven for thinking we’re still around to make the tea.

Cherchez la femme

Hence when I came across the so-called Hemline Index, I was startled.

Here were women! Predicting broad economic trends!

But not all of us, as it turned out. Just our legs:

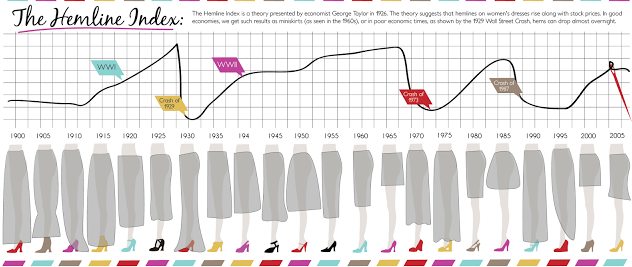

Source: via Fashionblogga

The economy of skirts

The Hemline Index, supposedly floated by economist George Taylor in the 1920s – although the poor guy was apparently misquoted – points to a link between stock market trends and the length of hemlines:

- When the market was climbing in the early 1920s and 1940s and again in the 1960s, skirts got shorter.

- When the market was about to crash, hemlines dropped.

Now anyone with the slightest knowledge of fashion history could point out gaping holes in this theory. But I don’t suppose the (mostly male) economists ever bothered to ask a Vogue editor.

Different social circles, I guess.

Anyway this deeply silly idea has continued to float around since the 1920s, as a way of forecasting economic change. But recently a Dutch economist (also male) carried out a proper study to test it.

And, shockingly, it turns out that hemlines can’t predict an economic downturn. They might move following one – several years later – but that’s about it.

So don’t go selling your shares because you’ve noticed a few girls wearing maxi skirts.

You couldn’t make it up

Pondering the perturbations of hemlines and the stock market led me to the Lipstick Index.

This is an even more peculiar theory.

Promoted by (male) American cosmetics billionaire Leonard Lauder – the 126th richest person in the world – the Lipstick Index has it that lipstick purchases are inversely correlated to the health of the economy.

Lauder argued that when times are hard (and I always appreciate a billionaire’s insight into these things), women buy lipstick instead of more expensive items like clothes and bags.

Hence you can predict an economic downturn by soaring lipstick sales.

Only you can’t, of course.

It’s not a completely stupid idea. It’s just not a predictive index.

Fickle index fashion

Leonard’s theory was originally put forward by economist and sociologist Juliet Schor as ‘the lipstick effect’. This described the consumer behaviour of treating oneself to small but conspicuous indulgences when times are hard.

The behavioural trend is valid, but it only applies to lipstick when lipstick is in fashion.

And fashion is, notoriously, fickle.

During the 2010s, for example, people started talking about a Nail Polish Index. And when we were all at home or wearing masks during covid, it became the Mascara Index.

People buy small luxuries to make themselves feel better. And if they’re struggling, women sometimes buy make-up in order to keep-up appearances.

That’s it. Good luck trying to predict the stock market using mascara.

Hair today…

By this point though I had fallen down the rabbit hole of girly economic indicators.

I needed another hit! What else could economists invent to turn women into financial weather vanes?

Well, in 2023 we apparently all became recession brunettes:

Not to woman-splain, but things have gotten expensive and many people are looking for a lower maintenance and more economical approach to blonde hair — but without moving away from blonde completely.

[…] the balayage, bronde and scandi trends aren’t going anywhere, instead they’re often being adapted to fulfil customers’ wants and needs. It seems many are “opting for a cost-friendly approach which allows them to still be a blonde, but reduces the frequency of salon visits each year.”

(So often untouched by fashion’s fluctuations, I missed out on this one too, being a lazy long-term brunette already.)

What’s the theory? That the rocketing cost of going to the hairdresser to top-up your blonde combined with the squeeze on disposable income to encourage lower maintenance hair trends.

In other words, women have let their natural hair colour regain ground as they’ve skipped the salon. Or they’ve died their hair ‘bronde’ (a mixture of brown and blonde) because it costs less to maintain. It’s a transatlantic fashion – although looking south the Australian style magazines seem pretty horrified.

Thankfully recession brunettes aren’t (yet) being used to predict the future. It’s more seen as a reflection of the rising cost of living – driving what the Wall Street Journal called a ‘Great Unblonding’.

Blondes may have more fun but it seems brown is cheaper to run.

Index vs index

The Great Unblonding rather contradicts the Haircut Index, developed by Japanese researchers.

According to these guys, when women wear their hair long it’s a sign of a healthy economy.

The wonks theorise that maybe when the ladies are doing well, they have less time to think about getting a haircut. So avoiding the hairdressers is a sign of financial success rather than a sign of recession.

There are enough holes in this theory that I could drive a bus through.

Only it’s awfully difficult to drive a bus in my high heels…

Ain’t no high heel high enough

The High Heel Index was developed by Trevor Davis at IBM, to match heel height to economic upturns.

Davis suggested a higher heel indicates an economic boom. Although he also found that at the start of a downturn heel heights initially went up, before going down after a few months if the economy didn’t rally.

So not an entirely obvious link, then.

I wonder if anyone’s ever combined these into a Financial Crash Superindicator?

Really bad news, surely, would be heralded by a brunette with red lipstick wearing a long skirt and very high heels.

Jessica Rabbit as the Fifth Horseman of the Apocalypse, perhaps?

Bare market

Finally, of course, there’s the Stripper Index.

Proponents of this will tell you that when the strippers start reporting a drop in club attendance combined with a sudden downturn in how much they’re tipped, financial disaster is on the horizon.

I’m not entirely sure of the robustness of this method of data collection, since it’s almost entirely anecdotal. But the economists seem to enjoy talking to the strippers about it.

(Don’t even get me started on the research into how Playboy’s Playmate of the Year tends to be ‘older, heavier, taller and less curvy’ in hard economic times. I’m not going near that one.)

The strippers on my social media feeds are saying that a crash is imminent (again). We’ll see how accurate they are.

But the big question is: does the underwear agree?

Getting to the bottom of it

You see, after I discovered index after index that painted women as mindless consumer-bots, I was thrilled to find one that turned the tables on men.

The theory behind the Men’s Underwear Index is that when men start feeling the pinch (no pun intended), they cut spending first on those things that people mostly never see.

No, not that secret folder of naughty pictures on their laptop labelled ‘Misc Receipts’.

Rather, their underwear.

According to this theory, an early indicator of impending economic crisis is a sudden drop in men’s underwear sales.

So while women repeatedly come across as vapid overspending beauty-obsessed trend followers, men are cast as cheapskates who don’t replace their underwear.

That’s equal opportunities for you.

Fashion index fatigue

A lot of these indices seem to fall into the ‘correlation does not equal causation’ trap.

They’re also pretty pointless. As The Investor said years ago, you need a plan, not predictions.

Then again, it’s nice that the economists have something to do on a Friday afternoon when they’re bored of actual work.

And what do I know, anyway? My little female head is too busy with thoughts about skirts and shoes to handle Important Ideas.

Excuse me while I rush off to buy a lipstick to make me feel better about being poor.