I was at Future Proof in California this past week.

Me and 5,000 friends:

The experience of this event is off the charts good.

Everyone’s in a fabulous mood. There’s great content, conversation, views and weather. Plus it’s so much fun.

However, I never get any of my typical work done during the week of Future Proof.

I’m too busy talking, walking around, catching up with old friends, meeting new ones, recording podcasts, moderating panels, emceeing the various stages, eating, drinking and maybe sneaking away to the pool for a swim, fish tacos and a Miami Vice.

That doesn’t leave much time to pay attention to the markets or do my usual reading and research. So when I got back from California, I spent a couple of days playing catch-up.

Here are a few of the stories, charts and market action that caught my eye:

Oracle’s insane move. Oracle was up as much as 40% on Tuesday after reporting earnings.

This headline from CNBC is kind of funny:

It’s wild that a corporation worth nearly $700 billion could see its market cap rise more than one-third in value on a single day.

This chart from Sherwood News helps explain why it happened:

The company’s forecast for cloud-related revenue by the end of the decade is up 14x over last year’s revenue for that division.

That huge move helped vault Oracle into the top 10 of the S&P 500 by market cap (via Bespoke):

Larry Ellison’s company is closing in on a trillion-dollar market cap, but something else about this table caught my eye.

One of these things is not like the others. Give up?

Notice anything on this one that’s not like the others?

Warren Buffett!

The top 10 list is 9 tech behemoths and Berkshire Hathaway. Would it be hyperbole to suggest this might be one of his greatest achievements? Buffett survived the dot-com bubble. Now he survived the AI bubble whatever we’re calling this.

I wonder how long until the top 10 is all tech stocks.

The stock market doesn’t care about the labor market…yet. First there was the big news that the BLS had its largest annual jobs revision on record. In the 12 months ending in March 2025, there were 911k fewer jobs created than originally reported.

That’s around 76k fewer jobs created each month. So the labor market has been slower than we thought.

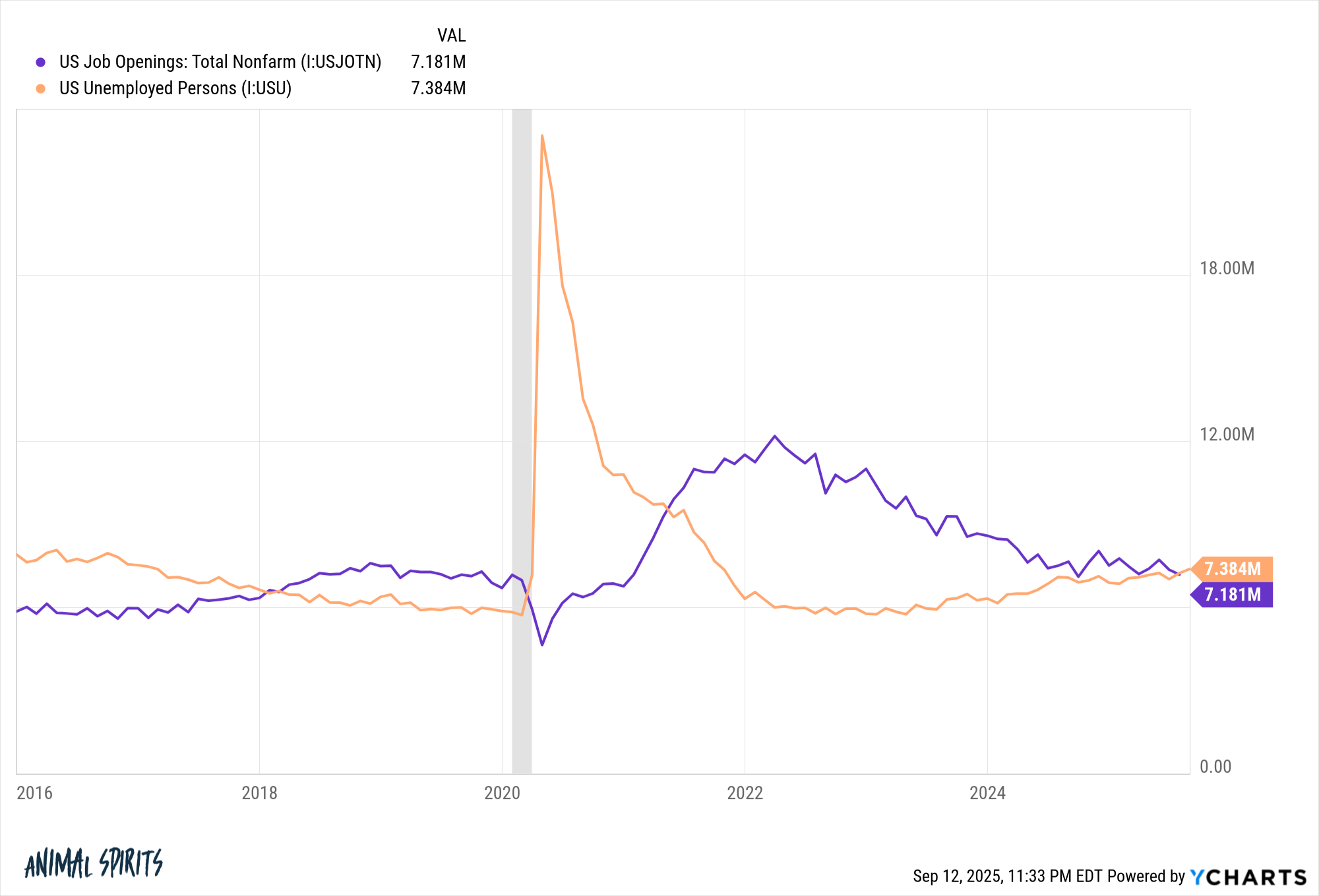

Then came the news that there are now fewer job openings than unemployed people looking for work:

This is the first time this has happened since the pandemic. When the labor market was running hot in 2022, there were millions of job openings over and above the unemployed population.

It’s not a complete disaster but it would be foolish to ignore the fact that the labor market has cooled off.1

The stock market’s reaction to a slowing labor market is essentially this meme:

Despite all of this news about the slowing labor market, the S&P 500 hit 3 new all-time highs this week alone. There have been 24 new highs this year and 43 in the past 12 months.

Maybe the stock market had it all priced in.

Maybe the stock market won’t care about the labor market until there’s an actual recession.

Maybe the stock market only cares about AI right now.

Or maybe sometimes the stock market and the economy disagree with one another.

Is the stock market smarter than us all?

Sometimes yes, other times no.

We shall see.

Further Reading:

Some Charts That Will Surprise You

1I also think the combination of AI, immigration reform and the normalization of the pandemic economy is making it very difficult to handicap the labor market.