There are 70+ million baby boomers.

Many of them are retired. Most of them will be in relatively short order as 10,000 or so people will retire every day between now and 2030.1

They are all trying to figure out the best way to spend down the financial assets they’ve managed to accumulate over the years.

Just like no one teaches you how to save for retirement no one provides the roadmap to spend it down either. There are so many unknowns in the process — your lifespan, inflation, market returns, your health, unexpected events, etc.

The first person to take a crack at solving this problem was an advisor by the name of Bill Bengen. Bill published Determining Withdrawal Rates Using Historical Data in October 1994 in the Journal of Financial Planning.

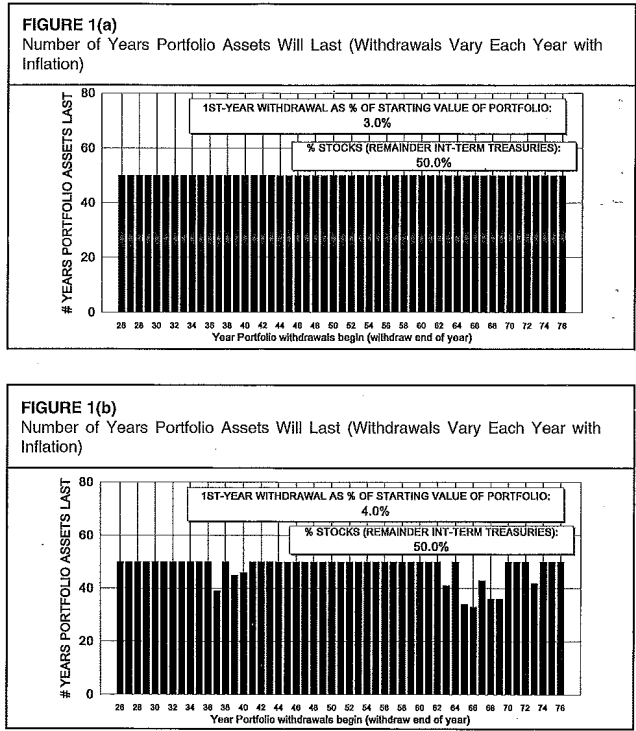

Bengen’s research sought to determine the initial starting share of your portfolio you could take from a balanced portfolio, increase that initial amount by the rate of inflation and not run out of money over the course of 30-50 years in retirement.

The safe withdrawal rate Bengen found that worked was actually 4.25% but the 4% rule rolls off the tongue a little better. It’s worth pointing out that “safe” requires some context.

This isn’t the baseline number — it’s the withdrawal rate that would have gotten you through the worst of the worst times, including the Great Depression and inflationary 1970s. The 4% rule was meant to help you survive the potential of retiring during one of the worst-case scenarios.

Most of the time a higher withadrawal rate would have done just fine while a 4% rate would have left you with far more money than you started with.

Portfolio withdrawal strategies are a planning process not a planning event because few variables are static in this equation.

Your spending changes over time. You typically spend more in your 60s and 70s than your 80s and 90s.

Market returns change over time. You have to account for the timing of bull and bear markets in retirement. A bear market at the outset can be a tricky proposition from a sequence of returns perspective. A bull market to kick off retirement offers you more flexibility to potentially spend or give more.

Inflation changes over time. Your personal spend rate can and will change over time. This should factor into your distributions as you age.

The ability to course correct along the way is imperative.

I spoke with Bengen on an all-new episode of Ben with Benefits at The Unlock.

We discussed:

- The origins and purpose behind the creation of the 4% rule.

- Common misconceptions about the 4% rule.

- How much flexibility should be involved in the withdrawal process.

- What inflation, bond yields, and diversification mean for your retirement withdrawals today.

- The safe portfolio withdrawal rate in 2025.

- Why the average safe withdrawal rate has been way higher than 4% in recent decades.

- Why many retirees end up with way more money than expected–and how to actually enjoy it.

- Plus we cover Bill’s new book, A Richer Retirement: Supercharging the 4% Rule that reveals how to spend more, stress less, and rethink retirement planning.

- How Bill applies this strategy to his own retirement spending plan and much more.

Check it out:

Subscribe to our YouTube channel so you never miss an episode.

Subscribe to the newsletter here.

Further Reading:

Do We Have Enough Advisors to Handle $80 Trillion?

1The number is actually close to 11,200 but the 10k number is round and people like round numbers.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.