I have a friend who is a tax consultant who works with a number of successful real estate investors.

He shared with me the secret to successful real estate investing based on his experience with these clients — you don’t sell. And the reason these investors don’t sell very often is because they hate the idea of paying taxes on their gains. So they more or less buy and hold their properties. A hatred of paying taxes made them extend their time horizons, thus boosting gains.1

It appears baby boomers don’t want to sell either.

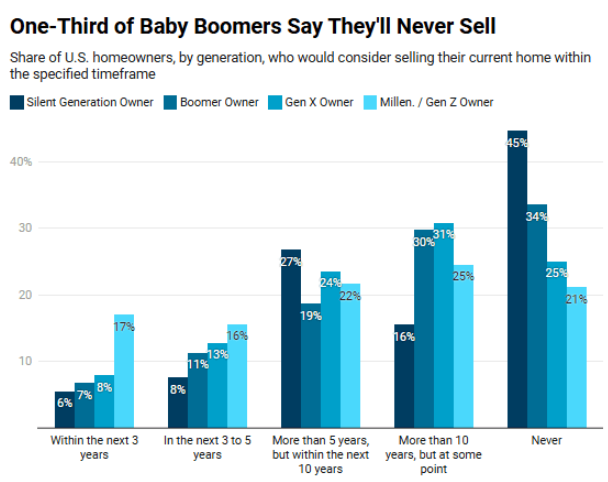

According to Redfin, one-third of all baby boomer homeowners say they’ll never sell their home:

One-third (33.5%) of baby boomers who own their home say they’ll never sell, according to a recent Redfin-commissioned survey. Another 30% say they’ll sell their home at some point, but not within the next decade.

Older people are even less likely to sell, with nearly half (44.6%) of Silent Generation members never planning to sell.

Here’s a further breakdown by generation:

Two-thirds of baby boomers have lived in their current residence for 16 years or longer. They are comfortable staying put in the same house for an extended period of time.

This strategy has paid off wonderfully for this generation.

Freddie Mac estimates that baby boomers are sitting on $17 trillion in home equity.2 Three-quarters of them plan to pass it down to the next generation. If you’re waiting for a wave of baby boomer homes to hit the market, it could be a while.

Some boomers probably don’t want to give up their low mortgage rate.3 Many of them have their homes paid off and that’s peace of mind, especially during retirement. So most are content to keep holding.

I write a lot about how it’s helpful to have a longer time horizon when investing in the stock market but it might be even more important in housing. Buying and selling a house can be expensive because there are loads of frictions in the process.

When you sell your house you pay the following costs:

- Realtor fees (4-6% of the sale price)

- Closing costs (1-3% of the sale price)

- Moving expenses

- Repairs and buyer concessions

Plus, when you buy a new home you probably get some new furniture and new decorations.

This doesn’t match. We need a new set of towels. We should probably paint this room or redo these floors to our liking.

There’s a reason housing activity is such an important part of the economy. There are a lot of knock-on effects when you go through the house buying and selling process.

Another reason you want to stay in any house you buy for an extended period of time is that the majority of your mortgage payment goes towards interest expenses in the early days of homeownership.

If you take out a $500k loan for a house right now at prevailing mortgage rates (~7%), the interest portion of your first payment is nearly 88% of the total, meaning just 12% goes towards paying down principal. Sure, prices could continue rising but building equity usually takes time.

It’s not easy being a homebuyer in the current climate. Prices and mortgage rates are both stubbornly high.

If you are a buyer the best thing you can do is to find a home that you are willing and able to stay in for many years.

The best way to make money in real estate is to own it for a long time.

Further Reading:

How Much is the U.S. Housing Market Worth?

1I know there are things like 1031 exchanges so I’m generalizing here.

2There is around $35 trillion of home equity in total. So boomers hold half of the home equity in America.

3I’m certainly not in a hurry to give up our 3% mortgage.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.