U.S. households are in debt to the tune of nearly $20 trillion.

That’s a lot of liabilities.

The majority of that debt resides in mortgages (68%) while the remaining balance is mostly student loans (8%) and auto loans (8%). That sure seems like a lot of money but that figure is meaningless without some context.

Total household assets as of year-end 2024 were close to $180 trillion. The assets dwarf the liabilities:

With a net worth of $160 trillion, we are truly a wealthy nation. But that wealth is not evenly distributed and also requires context.

Check out the median household net worth1 (via Jeremy Horpedahl):

At around $140k, this is a huge improvement following the trough of the Great Financial Crisis. It’s at an all-time high.

But this median number makes it clear that most of the wealth in this country is concentrated at the top. Some of this is natural because young people are always going to start out with a negative net worth. This is also a feature of capitalism, right or wrong.

Goldman Sachs has a chart showing equity ownership by wealth level going back to 1990:

The top 1% owns more than 50% of the stocks, while the bottom 50% owns 1% of the stocks.

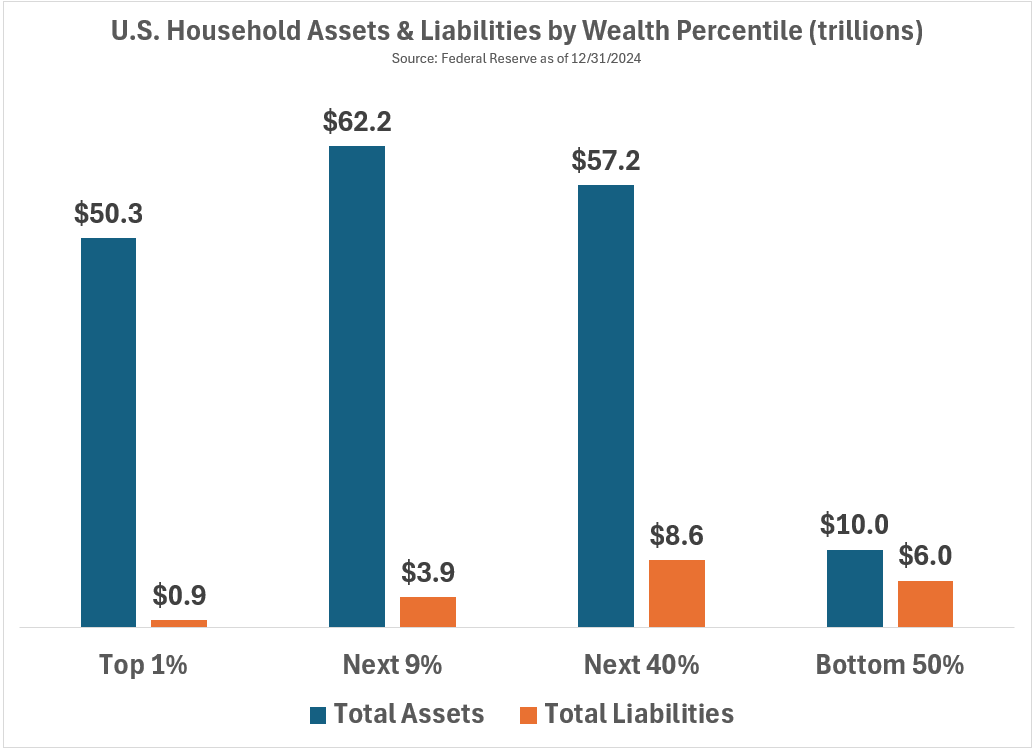

Here’s a further breakdown of the assets and liabilities by the various wealth segments:

The wealthy class has a lot more assets while everyone else holds more debt. Look at these numbers as a percentage of the totals:

The top 10% owns nearly two-thirds of the financial assets with just one-quarter of the debt. The bottom 90% owns 37% of the assets but 75% of the debt.

There are a lot of wealthy people in America. Look at the growth in the number of millionaires over time:

At one out of every six households it almost doesn’t feel unique anymore.2

The Cut had a story recently about how it’s a weird time to be rich and this passage stuck out to me:

A real-estate agent who sells luxury properties in the tristate area is seeing the same thing. “It’s a weird time to be rich right now,” she says. “All the wealthy people I know are keeping their cards closer to the chest.” Sure, maybe they’re a smidge unnerved by the economy’s flashing red warning signs, but they’re largely immune to such things. “When people have that much money, stuff like inflation doesn’t really affect them,” she says. What they do care about, though, is being judged for their conspicuous consumption. “When the whole world is crying poor and you’re living your life in this wealthy bubble, it’s really frowned upon,” she says. They’ve all seen The White Lotus. “No one wants to be like that.”

Set aside the ridiculous White Lotus guilt. The idea that inflation doesn’t really affect this group is interesting. When looking at the ratio of assets-to-liabilities it makes you wonder if most wealthy people are more or less immune to economic cycles.

Obviously, financial asset prices rise and fall. Businesses go bankrupt. It’s not everyone at the top of the wealth chain.

Maybe it’s always been like this but with more and more wealth concentrated at the top it’s worth thinking through the ramifications here.

The top 10% accounts for half of all spending in the U.S. economy. What will it take for this group to rein in their spending?

Even a run-of-the-mill recession probably won’t do the trick.

The consumer has been far more resilient than most macro pundits expected in recent years.

Rich people are a big reason why and there are more rich people than ever before.

Michael and I talked all about the top 1%, rich people everywhere and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

The Middle Class, The Top 10% and the Bottom 50%

Now here’s what I’ve been reading:

Books:

1This data is as of 2022 because that’s the last Fed household survey so the number would be higher now but not enough to make a huge difference.

2Worldwide there aren’t nearly as many millionaires and it is a unique thing.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.