Some charts that caught my eye this week:

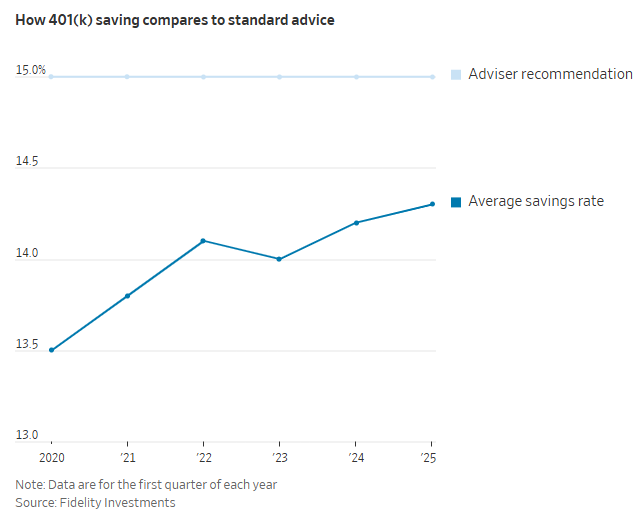

1. Retirement savings are better than expected. Here's something I wrote in Everything You Need to Know About Saving For Retirement:

My only retirement rule of thumb is that your savings rate should be in the double digits as a percentage of income. If you do nothing else in your financial life than setting a high savings rate you'll be alright. Ten percent is a nice goal while 15% to 20% of your income would be even better.

Guess what?

We're there.

The Wall Street Journal had a story this past week that shows retirement savers are saving close to 15% of their earnings:

Workers are putting away a record share of their income for retirement.

The average savings rate in 401(k) plans rose to a record high 14.3% of income in the first three months of this year, according to a Fidelity Investments analysis of the millions of accounts it manages.

Here's the chart:

Investor behavior has improved and savers are increasing their savings rates over time.

This is great news!

Would it be nice if the average balance were higher than $127,100?

Yeah it would but let's focus on the positives here.

2. International stocks have been outperforming for longer than you think. Foreign stocks are crushing the U.S. stock market this year:

Some countries are doing even better:

Stocks around the globe are finally winning by a large margin.1

It feels like this is a recent phenomenon but Jeffrey Kleintop has a chart that shows foreign stocks have been outperforming for longer than you think. This chart shows European stocks versus U.S. stocks going back to the bottom of the 2022 bear market:

We're now looking at nearly three years of outperformance for international equities.

This is an interesting development.

Will it last?

I don't know.

AI might have something to say about this cycle.

3. AI might be unstoppable. Here's a chart from Mary Meeker's most recent deck on the state of tech:

AI adoption is happening at light speed pace. As the technology improves it's only going to become more entrenched in our everyday lives.

Maybe everyone is getting ahead of themselves on the potential for this technology. It wouldn't be the first time tech titans have promised us the world is going to change and then it doesn't.

But I don't see how you stop this train.

At this point, I would be more surprised if we don't see an AI bubble.

Michael talked about these charts, bubbles and much more on this week's Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Now here's what I've been reading lately:

Books:

1I'll have a follow-up post on the reasons for international outperformance.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.