Jim Simons created perhaps the greatest market-beating machine ever constructed at Renaissance Technologies.

The Medallion Fund returned a preposterous 66% per year for 30 years.

The fund traded a lot and I'm still not quite sure what signals the code-breakers and rocket scientists used. But in Greg Zuckerman's book The Man Who Solved the Market, one of the partners at the firm said they were only right about 50.75% of their trades.

No one bats a thousand in the markets. Everyone gets stuff wrong.

Here are some of the things I've been wrong about in recent years:

I thought bitcoin had a chance to become digital gold. At my daughter's soccer game last year I got into a crypto discussion with some of the other soccer dads. One guy is a huge bitcoin enthusiast. He asked for my long-term take.

I said if bitcoin becomes digital gold that would be a win.

He looked at me like I just ran onto the field and tripped on of the girls. That's it?! Bitcoin is gonna be way bigger than gold. Just watch.

Maybe that's the case but I think we can put the digital gold comparisons to bed for now.

When central banks around the globe wanted to diversify away from Treasuries they bought gold. When investors wanted a way to hedge higher fiscal deficits and a lower dollar they bought gold.

Bitcoin has been tanking while gold has been soaring.

I'm not going to pour dirt on bitcoin's grave just yet. Crypto has looked deader than a doornail many times before and come roaring back.

But this environment is a blackeye for the crypto space. Everything we were told bitcoin could be has not come to pass.

It's still basically acting like a tech stock:

I'm sure there will be a new bitcoin narrative in the future but the ones that have been trotted out so far haven't stuck.

I thought bitcoin had a chance to dethrone gold in this new age of technology and innovation.

So far, I've been wrong.

I thought the meme stock crash of 2021 would slow the speculation. At the time it felt like GameStop, AMC and the other meme stocks were a flash in the pan thing.

People had extra money from Covid checks and time on their hands because of the pandemic. Speculating on stocks made sense.

From the euphoric highs in early 2021, GameStop and AMC are down 71% and 99%, respectively. Losses of that magnitude were supposed to wipe out the speculative fever of the Reddit/Robinhood traders. That was my thesis anyway.

Nope.

Retail trading continues to take market share:

Retail traders are becoming larger players in trading individual stocks, options, and futures. They swarm themes and trades like a pack of locusts.

That's how you get a chart of silver that looks fake in terms of the parabolic rise and the insane crash we witnessed over the past week:

Social media has changed the market structure for good.

This is not going away.

I thought DoorDash would be a Covid fad. During the pandemic when we were all stuck in our houses it made sense that food delivery became more useful.

Once the world opened up again I assumed people would stop paying for convenience, especially when inflation skyrocketed in 2022.

Wrong.

According to The New York Times, nearly three out of every four restaurant orders aren't eaten in the restaurant. Look at the revenue growth for DoorDash by year:

That's nearly 40% year over year growth in sales since 2020.

For many households, paying for the convenience of food delivery went from luxury to necessity.

This was not a fad.

Many households are now addicted and it's changing the food industry (some would say for the worse).

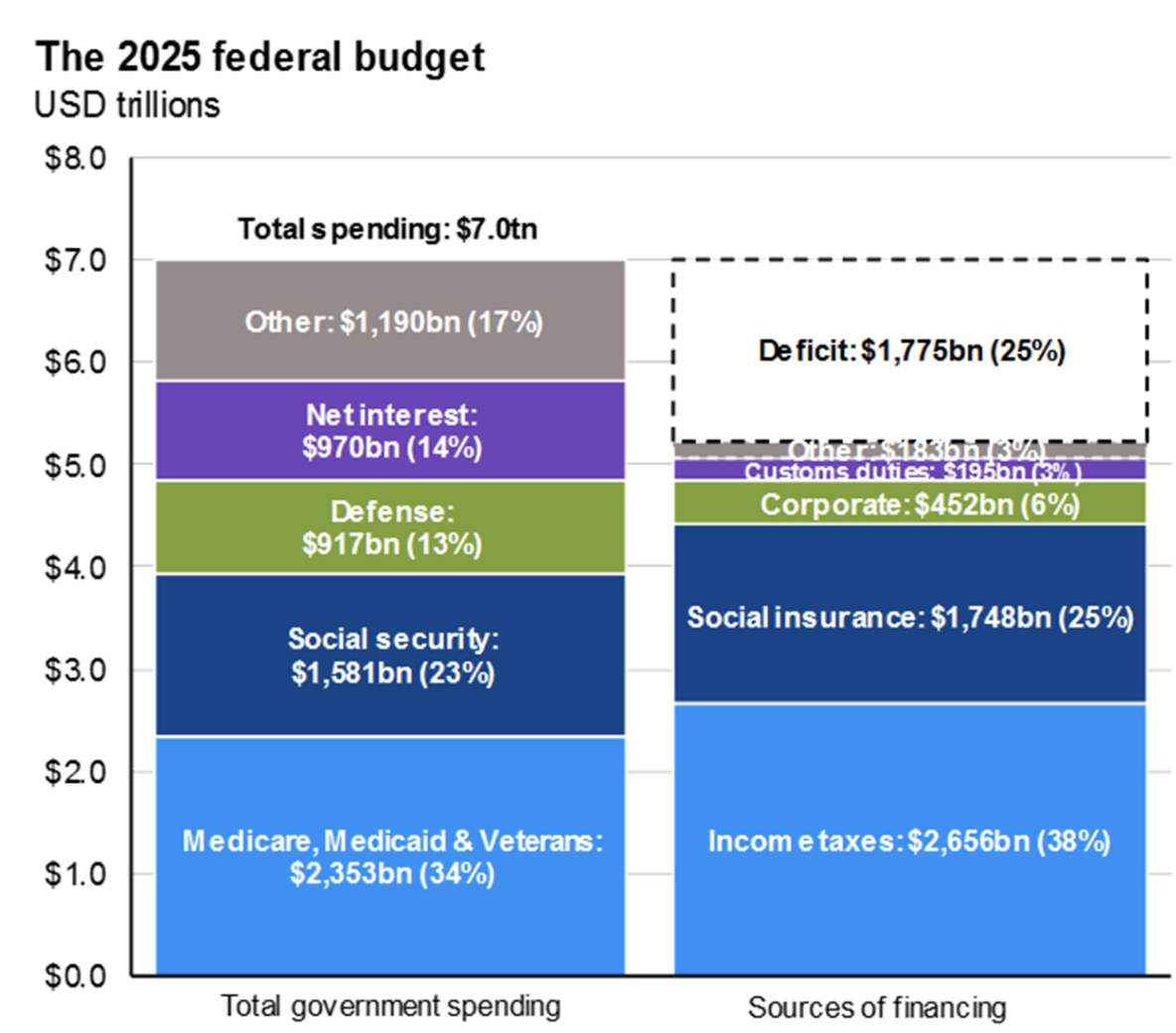

I didn't think the Fed would be able to raise interest rates so high because of government debt levels. I wrote a blog post back in 2021 about how interest rates needed to be kept low because of our ballooning government debt.

That one ages like a High Noon left in the sun all day.

My thesis was based on the idea that we couldn't allow the interest expense to eat up a huge portion of the budget. That was wrong.

You can see government debt rocketing higher this decade:

In 2022, the interest expense on our debt was roughly $400 billion or 7% of total spending. Last year it was 14% and nearly $1 trillion:

I guess we just decided to borrow more and pay the higher rates.

I should have known.

I thought the Lions were going to make the Super Bowl one of these years. The NFC Championship game against the 49ers two years ago was our opportunity. Now it feels like the window has closed. Oh well.

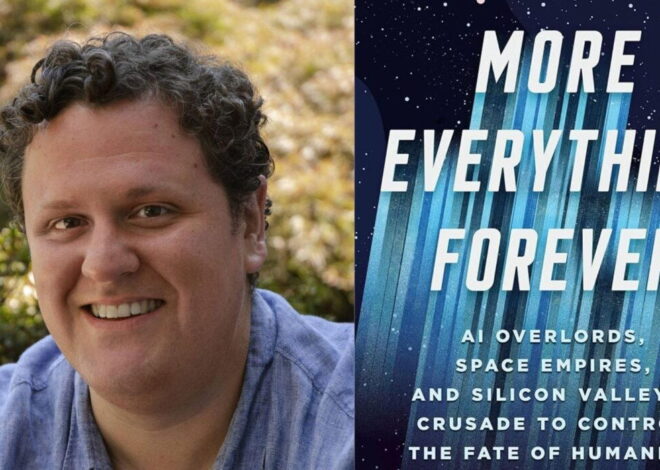

I thought an AI bubble was inevitable. Based purely on the history of how these things work, my baseline position has been that all the AI capex would lead to a bubble. It still might.

But AI is progressing so quickly that you have to have an open mind about a scenario where this whole thing isn't a speculative bubble that pops.

Anthropic's Claude Code is the first iteration of my AI dream which is a personalized AI assistant to handle multiple tasks for you at once.1 Claude seems to have singlehandedly taken down the stock prices of the software complex in recent weeks.

This one is still TBD but I think it's time to start thinking about the possibility that AI adoption happens faster than we imagined.

It's equal parts exciting and scary.

Michael and I talked about bitcoin, gold, DoorDash, AI and much more on this week's Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

The Railway Bubble vs. The AI Bubble

Now here's what I've been reading lately:

Books:

1My only hope for the AI boom is we all get a Scarlett Johansson-like personal assistant from the movie Her.