.bh__table_cell { padding: 5px; background-color: #dddddd; }

.bh__table_cell p { color: #222222; font-family: ‘Helvetica’,Arial,sans-serif !important; overflow-wrap: break-word; }

.bh__table_header { padding: 5px; background-color:#dddddd; }

.bh__table_header p { color: #222222; font-family:’Trebuchet MS’,’Lucida Grande’,Tahoma,sans-serif !important; overflow-wrap: break-word; }

Advertisement

Hunting for High Monthly Income?

|

Put the Calamos Autocallable ETFs on your radar. Latest distribution (paid December 30): • CAIE per share $0.32453 (14.36% annualized) Income that works harder. Calamos Autocallable ETFs – Earn More |

Today's Talk Your Book is sponsored by Simplify Asset Management:

-

See here for more information on Simplify Asset Management

On today’s show, we discuss:

-

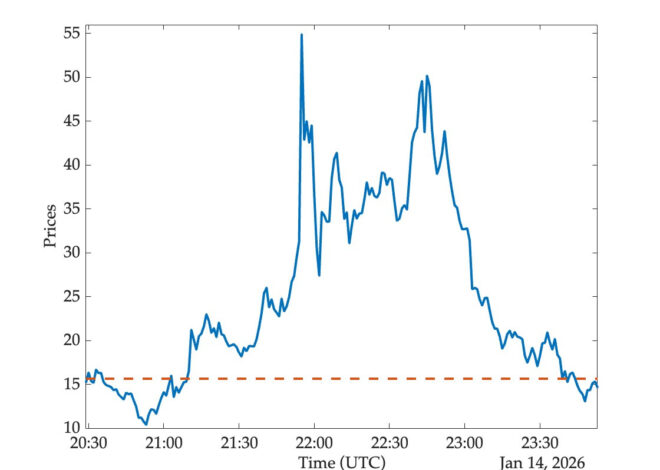

What is an auto-callable barrier income strategy?

-

Gaining access to structed notes through SBAR in an efficient, liquid wrapper

-

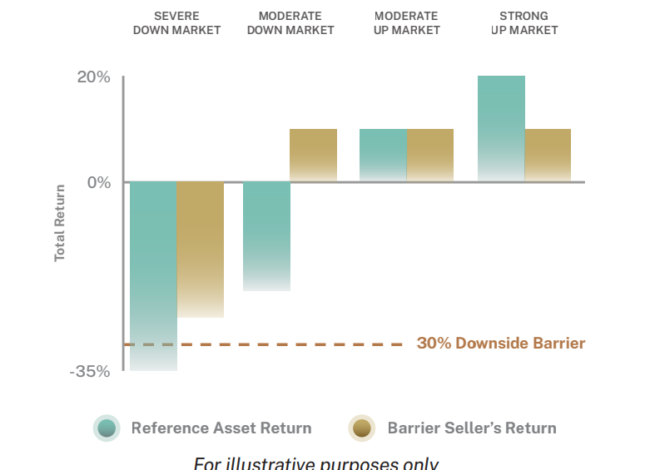

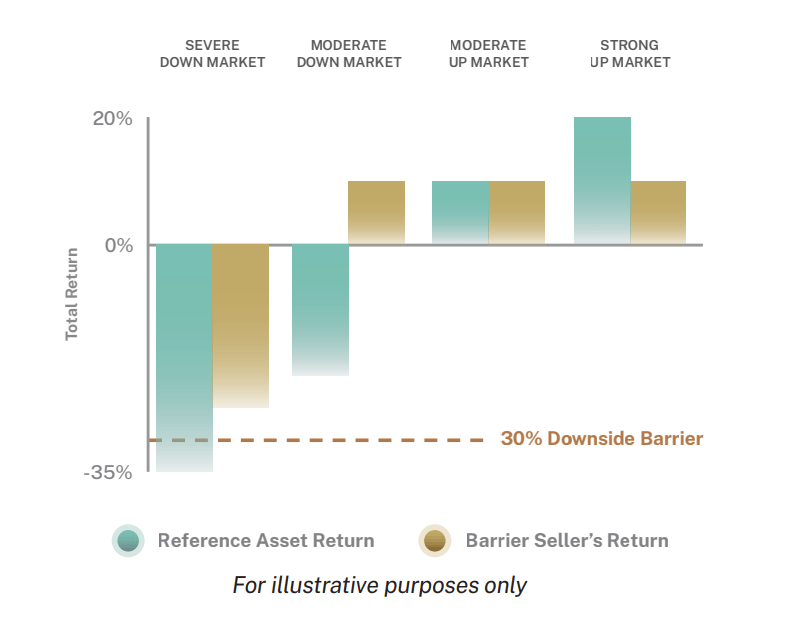

How do barrier options work?

-

How this strategy can offer drawdown protection as well as income

-

Returns driven by equity volatility and equity drawdowns

-

Trading off lower barriers in exchange for higher distribution yield

-

The use case for auto-callable barrier income strategies

Animal Spirits:

Charts:

Contact us at animalspirits@thecompoundnews.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

-

Apple

-

Spotify