My first passive real estate investment (other than REITs) was through a crowdfunding platform. This was back around 2018, not long after Congress passed regulations allowing everyday investors to participate in real estate deals without being accredited investors.

I was excited about it. I wrote about these platforms constantly on our blog. Fundrise, Arrived, Streetwise, Groundfloor, Concreit… I wanted firsthand experience so I could share what actually worked.

Seven years later, I’ve mostly moved on from crowdfunding platforms. Not because the concept is bad, but because the results have been disappointing. Let me walk you through what happened.

The appeal of these platforms is obvious. Low minimums (sometimes as little as $10 or $100), no accreditation requirements, easy signup, and exposure to real estate without becoming a landlord. For people who want to dip their toes into real estate investing, crowdfunding seems like the perfect on-ramp.

And for a while, it worked reasonably well. Returns were decent. The platforms were growing. I recommended several of them to readers.

Then 2022 happened. Interest rates spiked, the real estate market shifted and a lot of these platforms started showing cracks.

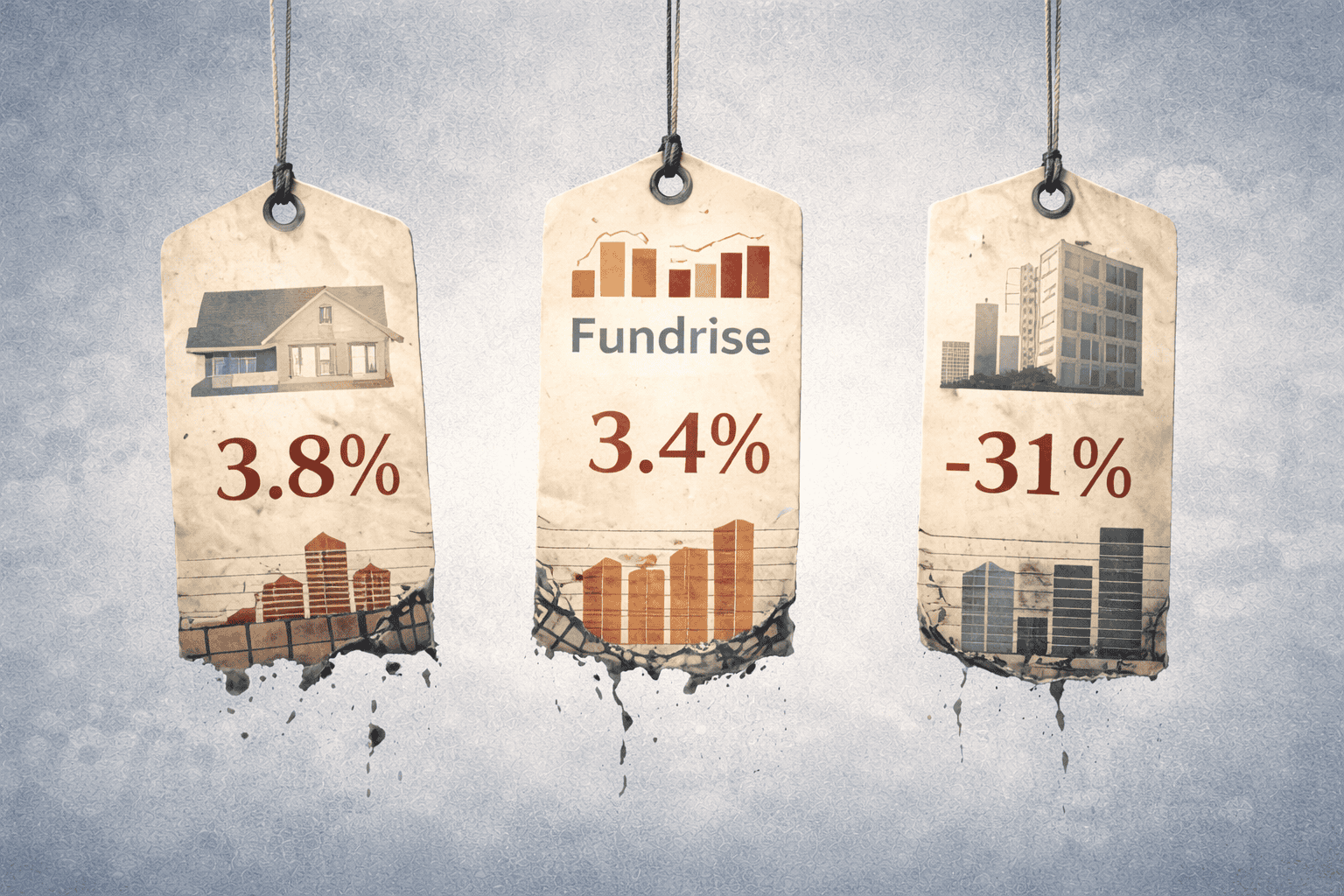

1. Fundrise: 3.4% Annualized Returns

Fundrise was probably the most popular real estate crowdfunding platform for years. Slick marketing, easy interface, low minimums. I invested across several of their funds starting around 2018.

My annualized return was 3.4%.

That’s not a typo. Over roughly seven years of investing with Fundrise, my net annualized return has been 3.4%. That barely beats a savings account. It significantly underperforms the stock market. And it dramatically underperforms the passive real estate investments I’ve made through other channels.

Fundrise was heavily invested in assets that got hammered when interest rates rose. They ended up with distressed properties they had to sell at a loss. In fact, through the Co-Investing Club, we’ve actually invested in deals where the operator was buying distressed assets from Fundrise because they needed to unload them.

When the platform that’s supposed to be managing your money is fire-selling assets to operators I’m investing with separately… that’s not a great sign.

2. Arrived Homes: 3.8% Across 17 Properties

Arrived lets you buy fractional shares of single-family rental properties for as little as $100. The idea is you get exposure to rental income and appreciation without buying a whole house.

I invested in 17 properties on their platform. That’s not a small sample size. My annualized return across all of them? 3.8%. And 99.5% of that came from rental cash flow, not appreciation.

The core problem with Arrived is their business model. They buy new or almost-new homes that photograph well for their website. Polished marketing, beautiful listings. But that’s not how you make money in rental real estate.

I used to be a landlord myself. The way you actually generate strong returns is buying distressed properties off-market, fixing them up, and renting them at full market value. You create equity through the renovation, not by paying retail for a pretty house.

Arrived is optimized for marketing, not returns. The properties look great on the website, but they’re not acquired at prices that allow for meaningful investor returns.

3. Streetwise: Down 31%

This one hurts. Streetwise focused on office buildings, and my portfolio with them is down 31%. Not underperforming. Actually lost nearly a third of my investment.

Office real estate has been brutal since the pandemic. Remote work hollowed out demand in a lot of markets. Streetwise got caught holding assets that cratered in value.

At least Fundrise and Arrived delivered positive (if underwhelming) returns. Streetwise lost me money outright.

Not every crowdfunding platform has disappointed. A couple have delivered reasonable results.

1. Groundfloor has been my favorite of the bunch. They make short-term hard money loans to house flippers and BRRRR investors, secured by the properties. You can invest with as little as $10. My returns have averaged in the 8-10% range, which is comparable to long-term stock market returns.

The downside is that some of these loans drag on way longer than expected. They’re supposed to be six-month loans. Some in my portfolio have been outstanding for years because the borrower didn’t complete the project on time. Groundfloor eventually forecloses, but your money can be locked up indefinitely. That’s frustrating.

2. Concreit has also been stable. They pay a yield that fluctuates between 5.5% and 7% (currently around 6.65%). It’s a large diversified pool of notes and some equity investments. The nice thing about Concreit is liquidity. After a two-month lockup, you can withdraw your money and typically get it back within a week. They charge early withdrawal fees (2% in year one, 1% in year two, nothing after that), but having that flexibility is worth something.

Neither of these is going to make you rich. But they’ve been consistent, which is more than I can say for Fundrise, Arrived, or Streetwise.