Bitcoin is bleeding against gold’s record breakout but a “power law” slip hints at a $324k price snapback

I keep thinking about the kind of person who owns a little Bitcoin tucked away for the future, a little gold tucked away for the past.

They are usually calm people; they do not trade headlines, they do not care about the daily noise, and they just want something solid on both sides of the monetary fence. For years that felt sensible, because Bitcoin’s long arc against gold looked like a one-way street, more ounces over time, fewer regrets.

Then January happened.

Gold sprinted. Bitcoin did not.

Gold pushed toward record territory, flirting with $4,900 an ounce, fueled by the kind of anxiety that tends to show up when geopolitics gets weird, and bond markets start acting like they have a pulse of their own, as gold watchers noted this week.

Bitcoin, meanwhile, stayed stuck in a narrow band around $89,800.

That gap is the whole story.

The ratio that made people sit up

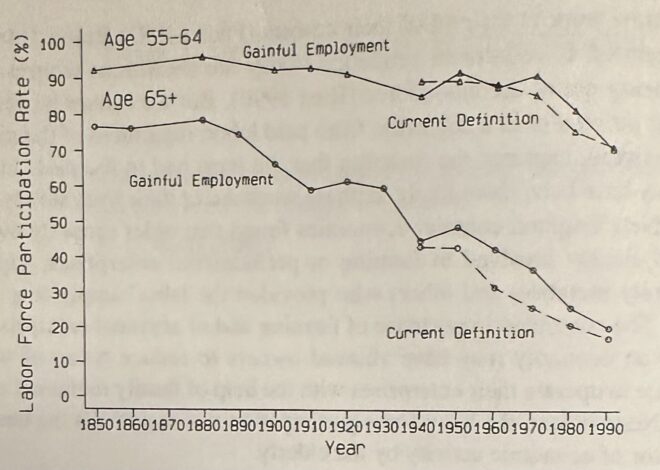

If you want one number to describe what’s different right now, it’s BTC priced in gold.

Take Bitcoin’s dollar price, divide it by gold’s dollar price per ounce, and you get how many ounces one BTC buys. When gold rockets and Bitcoin waits, that number falls fast.

That is why this chart is spreading, the “BTC/Gold power law” graphic, and why analysts like Plan C are calling it a historic deviation and hinting at a monster mean reversion.

The plain English version of that argument is simple. People who think in terms of models believe Bitcoin has a long-run “path” against gold, and that the market has wandered far below it. The more technical version is a power-law corridor with quantile bands, popularized in various forms by model builders and trackers, such as power-law dashboards.

Either way, the emotional punch lands the same. A lot of long-term Bitcoin holders have not had to watch gold “win” like this in a long time.

Why gold is doing what it’s doing

Gold is no longer moving like a sleepy hedge. Big banks are treating the move as something with legs.

Goldman Sachs just raised its end-of-2026 forecast to $5,400 an ounce, up from $4,900, pointing to a new wave of private demand and the steady pull from central banks.

One detail matters more than it sounds. Gold is doing this while real yields stay meaningfully positive. The 10 year TIPS yield was around 1.94% on January 22.

That’s not supposed to be ideal for a metal that pays no yield, yet it keeps climbing. When that happens, you usually learn that the buyer is not price-sensitive.

Bitcoin does not need a complicated explanation right now. It has been waiting.

Part of that wait shows up in flows. U.S.-listed spot Bitcoin ETFs saw about $1.1 billion in outflows over three trading days through January 8, and another $1.5 billion this week, wiping out the year’s early gains.

That does not mean institutions are “gone”; it means the marginal buyer has been fickle, and this market still depends on timing and mood more than gold does.

So Bitcoin stands there at $89,873, gold near $4,900, and the ratio looks like a trapdoor opening under the old narrative.

The trade everyone is quietly modeling

The easiest way to understand the mean reversion setup is to stop thinking in dollars for a second.

If gold stays around $4,900 and the BTC/Gold ratio climbs back toward the middle of the historical corridor that power law people expect, Bitcoin’s dollar price gets pulled upward almost automatically.

Here are the basic “if this, then that” numbers, using gold around $4,900 an ounce.

If the ratio sits near 18.5, Bitcoin stays roughly around $90,000; that’s the world we are in today.

If the ratio drifts up toward 35, Bitcoin lands around $171,000.

If the ratio reaches 45 to 60, Bitcoin lands around $220,000 to $294,000.

| Gold price (USD/oz) | BTC/Gold ratio (oz per BTC) | Implied BTC price (USD) | What this scenario implies |

|---|---|---|---|

| $4,900 | 18.5 | $90,650 | Status quo, BTC stays near current levels |

| $4,900 | 35 | $171,500 | Mean reversion toward “mid-band” style levels |

| $4,900 | 45 | $220,500 | Stronger snapback, BTC catches up while gold holds |

| $4,900 | 60 | $294,000 | Upper-tail move, the “$200k–$300k” conversation |

| $5,400 | 35 | $189,000 | Gold rises, ratio normalizes, BTC reprices higher |

| $5,400 | 60 | $324,000 | Gold rises and BTC/Gold mean reverts hard |

Notes: ratio is ounces of gold per 1 BTC, implied BTC price = (gold price per oz) × (BTC/Gold ratio).

If you combine that with Goldman’s $5,400 gold target for the end of 2026, the math gets louder, $189,000 to $324,000, depending on how far the ratio climbs.

These numbers do not predict anything, but they translate the wager into plain English. The wager is that gold’s strength makes Bitcoin’s underperformance feel “too far,” and the snapback could be violent.

The part model fans do not like to talk about

A model can be useful without being a map to the future.

Power law corridors look clean on log charts, and Bitcoin is a chart-friendly asset; it has trended for most of its life. That makes it easy for any long-run fit to look convincing, especially if the question is “does this generally rise over time?”

That’s why the real question here is not whether the chart looks good; it does. The question is: what kind of world are we entering?

Gold’s bid looks different when it holds strength alongside positive real yields, like the real-yield print shows. It looks different when major banks keep lifting targets, as the upgrade stories describe. It looks different when market stress headlines are the daily weather.

In that world, Bitcoin can still do well in dollars, and still lag gold for longer than traders want.

What to watch next, if you want to know which story is winning

This turns into a story about a few simple tells.

- Gold holding near highs while real yields stay firm, which leans toward structural demand and away from a quick cool-off. You can track that through the same TIPS series and spot gold updates like the Mining.com reporting.

- Bitcoin ETF flows stabilizing after those early January withdrawals, that leans toward rotation back into BTC, the easiest public window is the dashboard.

- Bitcoin leaving the $89,800 holding pattern, because right now the market is still waiting for a reason to move.

When people say “Bitcoin is undervalued in gold terms,” they are really saying something softer.

They are saying they expected Bitcoin to be the hard asset that wins the decade, and right now, gold is acting like it wants that crown back.

That’s why this feels like a black swan to some; the chart is the excuse, the emotion is the surprise.

- If gold’s surge cools and Bitcoin wakes up, the mean-reversion trade becomes a story people tell for years, the moment BTC holders got their swagger back and gold buyers blinked.

- If gold stays on top, this becomes a different story, about a market deciding that hard money means something older, quieter, and easier for institutions to hold without a second thought.

Either way, the BTC/Gold ratio is doing what a good relative metric does: it forces you to stop staring at one price and start asking who is winning the “hard asset” fight right now and why.