Yves here. Wolf Richter has two informative pieces on the latest inflation data. His companion post, Massive Outlier in Owner’s Equivalent of Rent Pushed Down CPI, Core CPI, Core Services CPI: Something Went Awry at the BLS, looks at where there was figures-fixing that had the effect of lowering the reported key inflation measures. This one looks at the continuing pain of food price increases.

By Wolf Richter, editor at Wolf Street. Originally published as Wolf Street

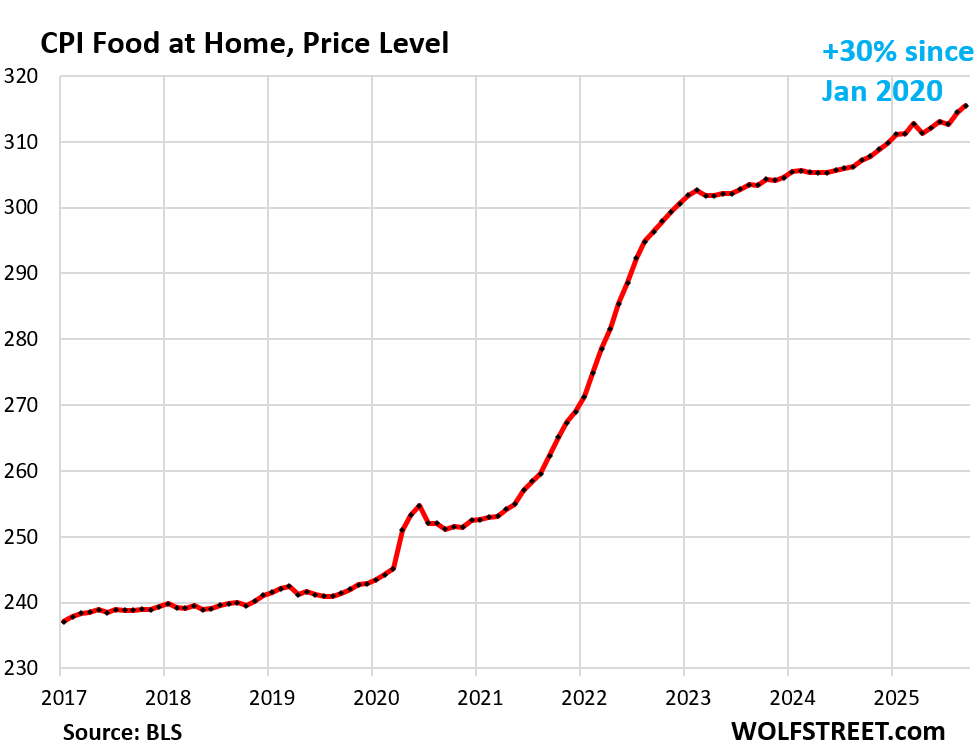

he CPI inflation index for “Food at home” rose by 0.32% in September from August (4.0% annualized), and by 2.7% year-over-year, the worst increase since August 2023, as per the data released belatedly by the Bureau of Labor Statistics today. Since January 2020, the CPI for food at home has surged by 30%.

The CPI “Food at home” tracks numerous categories of food and drinks that consumers purchase at stores and markets and consume off-premise, such as at home. But their prices don’t march in lockstep. Egg prices have re-plunged for months off their avian-flu spike and continued to drop in September. But beef prices soared. Coffee prices dipped off the huge spike. And dairy has been plateauing at very high levels. Hundreds of food and drink items form the overall food at home CPI.

This chart shows the price level of the CPI food at home: A surge in 2021 through 2022, a tiny dip in early 2023, and then continued but slower price increases that started re-accelerating in mid-2024. By now, prices of food at home have risen by 30% since early 2020.

Beef prices have been soaring for five years, as the US cattle herd has dropped to a 64-year low for a number of reasons, causing tight supply. Americans’ demand for beef despite high prices has continued to push prices even higher. Americans gripe, moan, and groan about high beef prices, but don’t give up on their beef easily.

Overall beef prices spiked by 1.2% in September from August, and by 14.7% year-over-year. But there are signs that the multi-year surge is beginning to slow.

For example, the average price of ground beef, which had exploded by 63% since the beginning of 2020, ticked up only 0.1% in September from August, which got lost as a rounding error, and the price per pound remained at $6.32.

The CPI for roasted coffee – includes roasted whole bean, ground, and instant coffee – dipped by 0.1% in September from August, after the multi-year spike that came in two phases, roughly following with some lag global commodity prices of green coffee beans:

- +22% from Jul 2021 to Feb 2023

- +21% from Aug 2024 to Aug 2025.

Since January 2020, the CPI for coffee spiked by 46%.

Green coffee beans, as a global commodity product, are traded on various platforms, and prices are very volatile, often driven by fears of droughts, bad harvests, market forces, and now tariffs.

For example, Arabica coffee futures prices (chart below via Trading Economics):

- +150% from mid-2020 – early 2022

- Then they gave up part of that spike.

- +125% from late 2023 – late 2024.

- In 2025, they spiked, plunged, and re-spiked and are now just below where they’d been in early February, as futures markets reacted strongly to tariff announcements.

These are violent price movements that don’t pass through to retail prices of roasted coffee. Since early 2020, coffee futures exploded by 300% while the CPI of roasted coffee sold by retailers rose 46% over the same period.

Egg prices have now collapsed after the spikes, but are still high. The avian flu came in two waves, the first in 2022 and the second in 2024, each triggering shortages of eggs, empty shelves, purchase restrictions when eggs were available, and huge price spikes.

The average price of Grade A Large Eggs had soared by 368% from $1.33 per dozen in mid-2020 to $6.23 at the peak of the second wave in March 2025. Since then, prices have plunged.

In September, they continued to fall, -2.8% for the month, to $3.49 per dozen Grade A large eggs, according to the BLS today. They have now plunged by 44% from the March peak, but are still 146% more expensive than they had been in mind-2020.

Dairy and related products were another shocker during the high inflation years of 2020 to 2022, when they spiked by 22%, and prices have remained at these high levels since then.

The CPI for dairy and related products declined by 0.5% in September from August, according to the BLS today. Year-over-year, it rose by 0.7%.

Major Categories of CPI Food at Home

Beef, coffee, eggs, and dairy are among the most volatile food categories. But there were other categories with price spikes, all for their own reasons. For example, prices of baby formula spiked in 2022 and 2023, amid shortages, suddenly putting enormous pressure on families with young children, while other consumers never noticed it.

The category “Coffee, tea, etc.” in the table below also includes tea and “other beverage materials.” The CPI for coffee shown in the chart above is just for coffee (ground, whole-bean, instant).

The category “Beef and veal” in the table is far broader than ground beef, the example in the chart above.

The category “Eggs” includes all types of eggs, not just Grade A large depicted in the chart above.

| MoM | YoY | |

| Food at home | 0.3% | 2.7% |

| Cereals, breads, bakery products | 0.7% | 1.6% |

| Beef and veal | 1.2% | 14.7% |

| Pork | 0.5% | 1.6% |

| Poultry | 0.1% | 1.4% |

| Fish and seafood | -0.3% | 2.1% |

| Eggs | -4.7% | -1.3% |

| Dairy and related products | -0.5% | 0.7% |

| Fresh fruits | -0.5% | -0.2% |

| Fresh vegetables | 0.0% | 2.8% |

| Juices and nonalcoholic drinks | 1.4% | 3.1% |

| Coffee, tea, etc. | -0.1% | 18.9% |

| Fats and oils | 0.3% | -1.7% |

| Baby food & formula | 1.3% | 0.6% |

| Alcoholic beverages at home | 0.0% | 0.3% |

Rising and spiking food prices, and these continued high food prices after a spike, cause a lot of hardship among consumers that aren’t rich who suddenly have to make all kinds of compromises to put food on the table. Food prices are nothing to be trifled with.