Three visuals that caught my eye in the last week or so:

$50,000 new car prices. Check out this chart from Sherwood News:

The average cost of a new automobile is now $50k!

The Washington Post notes that more than 60 models now have average prices of more than $75,000.

Crazy right?

Part of this is due to inflation. New vehicle prices are roughly 22% higher in the 2020s.

Part of it is due to the fact that technology is much better in new vehicles. There are all sorts of sensors, cameras, screens and self-driving features. Plus, you get Apple CarPlay in almost every new vehicle now. This all costs more money.

Part of it is due to the fact that more and more people are driving trucks and SUVs than ever before.

Add it all up and a new vehicle is much more costly than ever before.

The good news is that vehicles last much longer than they did in the past.

The bad news is that many people are stretching to buy these $50k new vehicles by taking on 84-month auto loans to make it work.

Unless everyone goes back to driving sedans this is the new normal.1

If you buy new, get used to higher prices.

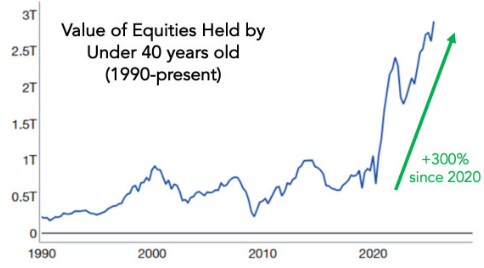

Young people are all in on the stock market. When the pandemic hit it was obvious there were going to be unintended consequences. What wasn't obvious is what those unintended consequences would be.

Here's one I never would have guessed when we essentially shut down the economy in March of 2020 — young people are participating in the stock market like never before (via Daily Chartbook):

The cynic would say this will end badly once the stock market rolls over.

I take more of a glass-is-half-full view of the fact that people under 40 are all in on the stock market.

This is wonderful news. Young people have the biggest thing you need when investing — time.

Talk to any older investor and they're bound to tell you their biggest regret is not starting earlier. Starting early is half the battle.

Sure, some of these young investors are learning bad habits. That will never go away.

The fact that so many young people are going to potentially compound their wealth in the stock market for decades is great news.

Health and wealth inequality. Between now and 2050, the number of Americans 65 and older is estimated to increase by 40%.

With 70 million baby boomers that means a lot of people living into old age and a lot of people needing care in the years ahead.

There was a story in the Boston Globe about how most people are unprepared for aging. I've seen studies before that show wealthier people tend to live longer but data blew my mind:

The wealthiest top 10% tend to live 9 years longer than the poorest 20%. The death rate for the poorest quintile is double that of the highest decile.

There are reasons for these differences.

People with more money generally have better access to healthcare, have better living conditions, can afford to live a healthier lifestyle, and have generational advantages like better access to education. Plus, financial stability can create less stress in your life.

This isn't everyone but it's clear we're going to see wealth inequality lead to health inequality in the years ahead.

Further Reading:

84-Month Auto Loans?!

1My local Honda dealership has the newest Accord at an MSRP of $28,295 for the standard trim.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.