I spent the first 10 years of my career working in institutional asset management.

I learned a lot in that space.

The past 10 years have been in the wealth management channel. That still involves some non-profits but also includes individuals, families, corporate retirement plans and family office clients.

Here are 10 things I’ve learned in my 10 years working in wealth management:

1. Alpha is overrated. Outperformance was the only thing people cared about in the institutional investment world. I understand why intelligent people have a desire to outperform the market but an obsession with alpha can be detrimental to your investment plan.

It leads to unnecessary risks, more portfolio changes and a short-term mindset. Plus there’s the fact that beating the market is hard!

The only benchmark that truly matters is this: Are you on track to reach your goals?

2. Trust is important. A product is tangible. You can look at it, feel it and know when it’s finished and ready to use.

Services are intangible. You don’t get to experience a service before you commit to paying for it. Financial services are not a finished product, but an ongoing process.

That’s why trust is such an important component for financial advisors and their clients.

It doesn’t matter how smart you are or how good your sales skills are if you can’t gain people’s trust.

3. Process in everything is key. Being process-oriented means you diagnose a problem before offering a solution, create rules to guide your actions and understand sometimes the outcomes are out of your control.

But you need processes to survive an unknowable future.

Process in financial planning. Process in portfolio management. Process in client communication.

You have to know when to deviate and make course corrections along the way.

But it’s impossible to survive in the markets or the wealth management business if you don’t rely heavily on a well-thought-out process.

4. Philosophy has to be universal. Strategy has to be personal. Everyone in a wealth management firm needs to be rowing the same direction for things to run smoothly. You need everyone on the same page when it comes to the overarching philosophy for investments, financial plans and client experience. No rogue agents.

But the individual strategy for each client has to be personalized if it’s going to work. Everyone has different circumstances, needs and desires and you have to build them into the plan.

The client always has more buy-in when the comprehensive plan is tailored to their particular situation.

5. There are a lot of good retail investors. There used to be a stigma attached to mom and pop retail investors.

They’re the dumb money. They’re the sucker at the poker table. They buy high and sell low.

Is that still the case with some investors? Sure and it always will be.

But there are so many more good DIY investors out there these days than ever before. I know it because I’ve seen thousands of different portfolios and track records.

Not everyone seeks out a financial advisor because their behavior is a disaster. There are plenty of people who have built wealth the right way who simply need more expertise in financial planning, want to outsource because their time is valuable or need to ensure their family is taken care of if something were to happen to them.

6. Many people need help spending money. I’ve written and spoken about this idea plenty over the years.

Americans are consumers at heart. I never anticipated the fact that so many people would have trouble spending down their savings but this is a real psychological hurdle.

It’s difficult to go from saving for 30-40 years and building up your net worth to spending it down and watching it diminish.

Financial advisors can provide a valuable service to their clients by helping them spend their money more confidently.

7. There are no rival financial advisory firms. There were thousands of advisors at our Future Proof event this past week. None of them acted like competitors.

Instead, people were creating bonds with their peers, sharing best practices and trying to help each other improve their business prospects and client toolkit.

It’s a collaborative industry with no natural rivals. Some firms are better for certain types of clients than others. Some clients want different things. Some firms want to grow while others are happy where they are.

One of the neat things about the financial advisory space is that there are all different types of firms and business models, and they are all running their own race.

8. Communication is a form of risk management. There are many forms of risk management. Diversification. Asset allocation. Hedging. Options. Position sizing. Stop-loss orders. Trend-following. Rebalancing. Asset-liability matching.

I could go on.

One of the best risk management tools in the wealth management industry is communication.

The best financial advisors understand their clients. They know which ones they need to be proactive with during unpleasant market environments.

Communicating what you’re doing, when you’re doing it and why you’re doing it can be one of the most helpful ways to manage risk on a client’s behalf.

9. Wealth is always in the eye of the beholder. I’ve spoken to people with tens of millions of dollars who don’t feel rich. I’ve spoken to people with far less money who can’t believe how lucky they are to have enough money to retire.

$5 million can be life-changing money for some people and not nearly enough for others.

No number truly makes you feel wealthy. It all depends on your expectations and surroundings.

Your burn rate and proximity to other rich people often has a much larger impact on your feelings about wealth than some numbers on a spreadsheet.

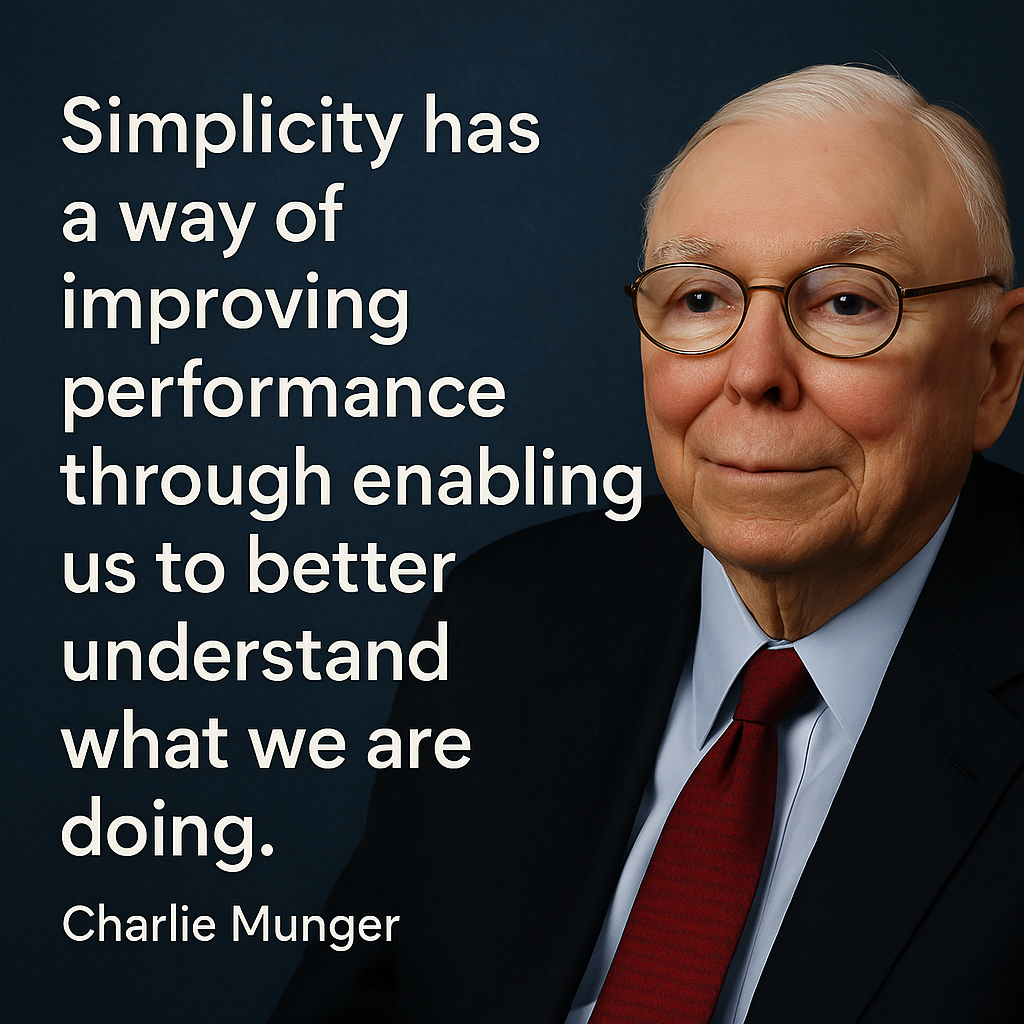

10. Simplicity wins. Complexity is easier to sell but the more complex a financial plan or portfolio becomes, the harder it is for clients to stick with it. Simple strategies, when clearly defined and explained, work better in the long run.

But simple is harder than complex.

You have to fight to keep things simple because your natural tendencies make you susceptible to stories and narratives. Simplicity is more of a psychological exercise while complexity is more about trying to outsmart the competition.

Complex problems like the markets or financial plans don’t require complex solutions.

Charlie Munger once said, “Simplicity has a way of improving performance through enabling us to better understand what we are doing.”

This is true for financial advisors and clients alike.

Michael and I talked about some things we’ve learned from building a wealth management firm at our live Animal Spirits from Future Proof in Huntington Beach this week:

Subscribe to The Compound so you never miss an episode.

Further Reading:

20 Lessons From 20 Years of Managing Money

Now here’s what I’ve been reading lately:

Books: