I had a joke in the 2010s that went like this:

I’m a contrarian.

-Everyone

It was cool to be contrarian coming out of the Great Financial Crisis.

We all read The Big Short.

Everyone wanted to be the next Steve Eisman, Michael Burry or Meredith Whitney.

Like most things in the markets, the contrarianism went too far. Everyone thought going against the grain was the way to make money.

Zero Hedge built a cult following of permabears during one of the great bull markets of all-time!

The investment office I worked for invested in a hedge fund that owned a piece of John Paulson’s fund that shorted subprime mortgages. Unfortunately it was a fund-of-funds so the allocation wasn’t large enough to make up for losses elsewhere. There was some regret that they didn’t go bigger.

The recency bias kicked in big time so in the aftermath of the crisis they created a new fund to invest exclusively in the next Big Short. Investors were excited about the opportunity at the time, but they tried shorting Japanese government bonds and some other esoteric trades that never worked.

Turns out once-in-a-lifetime trades don’t come around that often. Who knew?

Needless to say, this fund was closed in short order since the financial world doesn’t come apart at the seams every single year.

By the end of the 2010s the contrarian mindset started to shift. The bull market had gone on long enough to snuff out all of the crash calls. It died in the 2020s as first-level thinking beat the pants off of second-level thinking. Everyone came to realize that making predictions is easier than making money when it comes to being a perma-contrarian.

I guess you could say the new buy the dip mentality is contrarian in some respects. But in the early-2010s everyone thought the market was going to rollover again. Now everyone thinks it does nothing but go up. The big short has morphed into the big long.

You have people who made life-changing portfolio gains, not from betting against the herd but investing alongside of it. Why would you ever sell Nvidia, Bitcoin, Tesla, Facebook, index funds, etc.? Everything that falls immediately goes back up. Don’t fight the trend. Up and to the right.

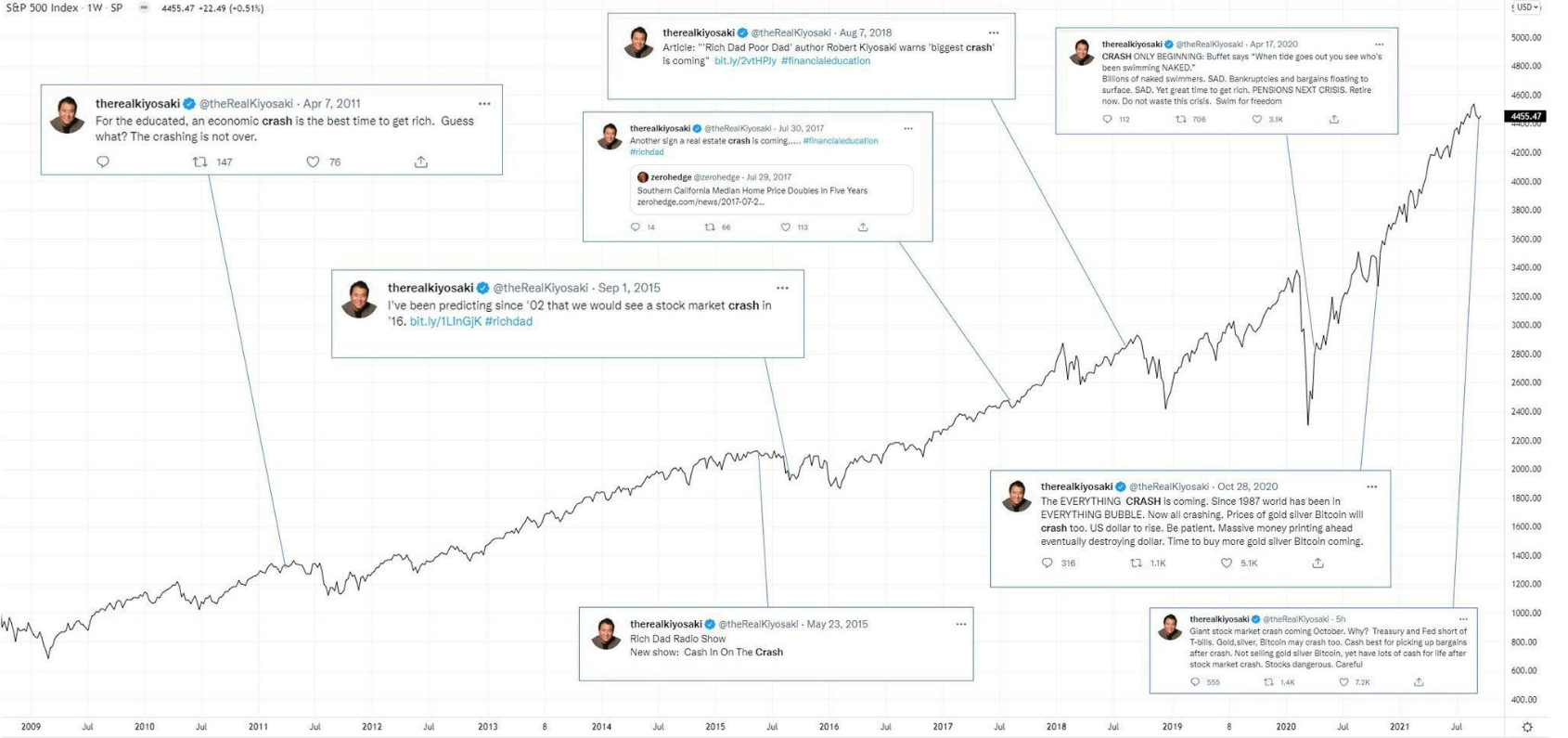

Permabears have basically been rounded up and thrown in pundit prison.

No one listens to these people anymore because they’ve been wrong for 15 years straight. Any time these people spout off people dunk on them relentlessly with all of the instances where they called for a systemwide crash in the past and were dead wrong.

That’s progress.

There’s also a huge difference between legitimate contrarians and permabear charlatans who prey on your worst financial fears.

We’re starting to see some rumblings from some reputable contrarians who are worried the current environment has gone too far.

Howard Marks wrote a new memo about AI, elevated valuations and why he’s worried:

The existence of overvaluation can never be proved, and there’s no reason to think the conditions discussed above imply there’ll be a correction anytime soon. But, taken together, they tell me the stock market has moved from “elevated” to “worrisome.”

Burton Malkiel wrote an op-ed for the New York Times with a headline that reads:

Here’s a passage:

No one can know for sure where the stock market will go next. But there are worrisome signs that investor optimism may have gotten out of hand. The recent exuberance of investors raises the question of whether they are making the same mistakes they made in the past — errors that could prove very costly down the line. If history is repeating itself, what can we do to protect our financial futures?

OK, sure. People have been saying we’re in the 9th inning since like 2017. What does this mean for investors? What should you do?

Marks offers up some options for people who are nervous:

And here’s his prescription:

Because “overvaluation” is never synonymous with “sure to go down soon,” it’s rarely wise to go to those extremes. I know I never have. But I have no problem thinking it’s time for INVESTCON 5. And if you lighten up on things that appear historically expensive and switch into things that appear safer, there may be relatively little to lose from the market continuing to grind higher for a while . . . or anyway not enough to lose sleep over.

That seems reasonable for people who are worried about the potential for an AI bubble bursting.

Malkiel gave similar advice:

Market timing can ruin a well thought out investment plan. Just because the market is bipolar doesn’t mean you should be too.

There are actions investors should take. If you are retired, and need money soon, you should invest it in safe short-term bonds. Suppose you are in your late 50s, and your retirement fund is well balanced, for example, at 60 percent stocks and 40 percent bonds. Check to see if the recent rise in stock prices has increased your equity position, perhaps to around 75 percent. If so, sell enough stock to get back to the preferred 60/40 allocation suitable for your age and risk tolerance. Periodic rebalancing is always sensible and gives you the best chance to buy low and sell high.

The hard part about trying to predict overvalued markets is that no one knows whether you’re in 1996 or 1999 when you’re in it. Everyone knows when you’re in a financial crisis while it’s happening. Bubbles are only known with the benefit of hindsight.

I have no idea what inning we’re in. There is speculative behavior and the AI spending binge is otherworldly. But people have been calling this market overvalued for well over a decade. The market can look irrational for a lot longer than you think.

Contrarians will make a comeback at some point.

The current environment cannot last forever.

But most of the time contrarians are wrong.

The trend is usually your friend…until it ends.

Michael and I talked about contrarians, overvalued markets and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Contrarians Are Usually Wrong

Now here’s what I’ve been reading lately:

Books: