Right or wrong, our economic system invariably creates haves and have-nots.

It’s a feature not a bug.

This feature has always been more prevalent in the stock market than the housing market:

The bottom 90% owns just 12.8% of the stock market1 but 56% of the housing market. The top 1% owns 50% of the stock market and less than 14% of the housing market.

The largest financial asset for the majority of middle-class households is their home.

My worry about the current housing situation is that it’s going to make it much harder for people in the middle class to keep up.

This is already starting to show up in the data.

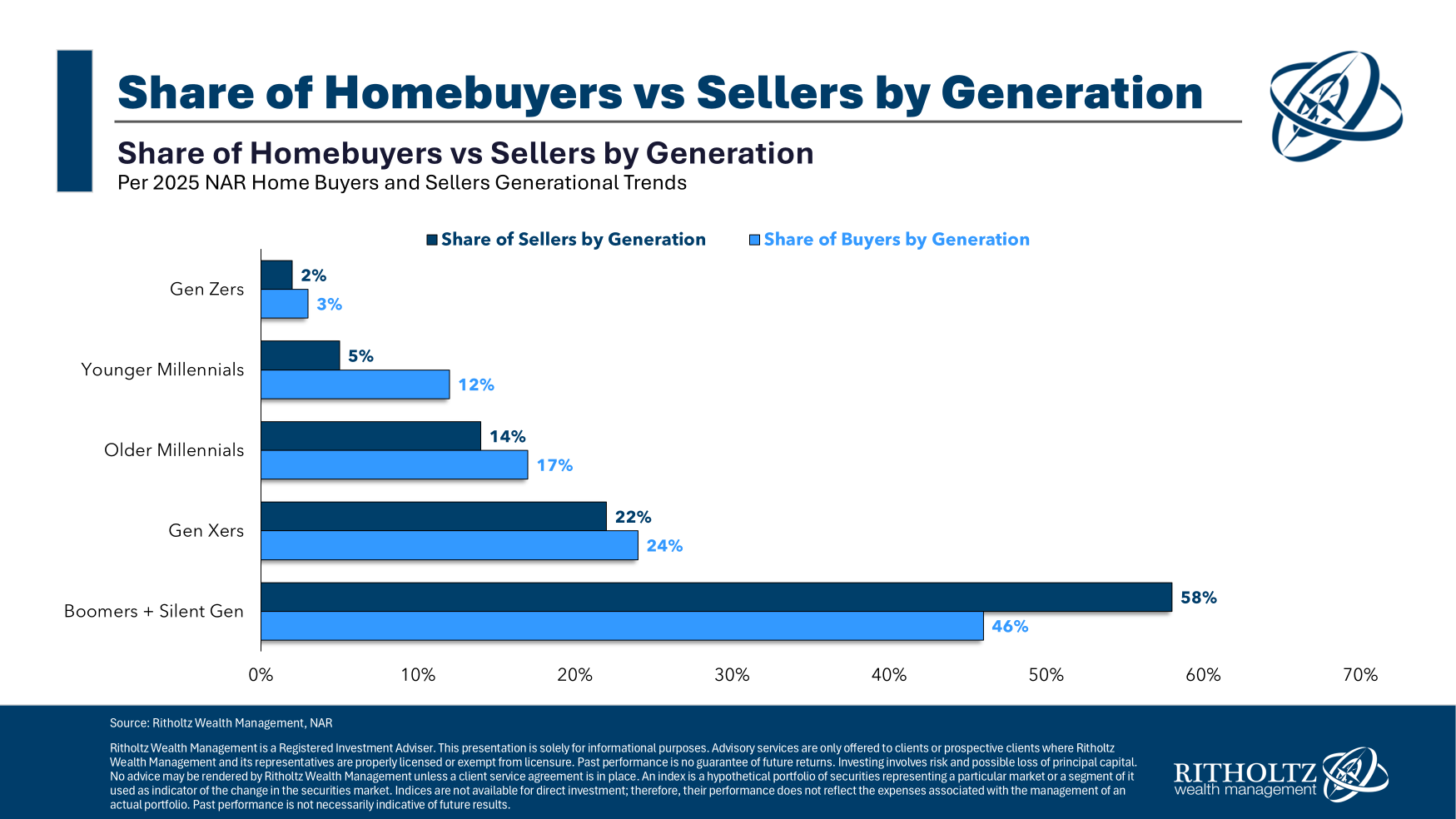

Baby boomers make up by far the largest share of home purchases and sales:

Older people are responsible for nearly 60% of all housing sales and close to half of all purchases. This makes sense when you consider 40% of all homeowners have no mortgage.

Boomers have tons of equity to play around with, so high prices and mortgage rates don’t matter to them as much as they do to young people.

Here’s another way of viewing this data from Torsten Slok:

To be fair the median age of everyone is now higher because baby boomers are older. It was around 30 in 1980 and is closer to 40 today.

But first-time homebuyers are getting boxed out of the market (via NAR):

The average age of first-time buyers is also going up:

You could explain some of this shift to more young people going to school for longer but this is mostly because you need to make more money to afford your first home now.

While many baby boomers are trading up or moving elsewhere for retirement, many are essentially locked into their current house whether they like it or not.

Here’s an email I got that is likely a common occurrence in many areas high cost of living areas:

My in-laws live in La Jolla, a very wealthy area here in San Diego. However they are by no means wealthy other than the house they own. They bought their house 45 years ago for something insane like $36,000, own it outright and it is now worth well over $4+ million.

They are in their 80’s and don’t want to sell because they don’t want to pay tax on the massive gains they have and take away the step-up basis that their kids would get once they pass. The house is way too big and way too much upkeep but they have the mentality that if they sell they are screwing over the next generations by taking $600k+ out of it so they feel trapped.

This is pretty common here, as there is a large aging population who are essentially waiting to die rather than selling which has large trickle down effects to the overall real estate market.

If you inherit a home from your parents, you get a step-up basis to the current fair market value when they pass away. In this situation, instead of a taxable gain of $4 million or so, if the kids sold right away they wouldn’t pay any capital gains taxes.

I totally understand where the parents are coming from here. That’s a massive advantage they’re providing to the next generation.2

But this also sets up a situation where housing in certain parts of the country turns into a caste system.

A housing market based on nobility creates even more barriers for the have-nots or those who aren’t born into a favorable family situation.

Lower mortgage rates will hopefully help when that finally happens but my worry is a lot of people are out of luck when it comes to buying a house.

This makes the stock market more important than ever as a wealth-building vehicle.

Further Reading:

How to Make Money in Real Estate

1This is actually an improvement from the last time I ran these numbers at the end of 2021. The bottom 90% owned 11.1% back then. The top 1% has dropped from 53.9% to 49.8%. That’s a minor dent but getting more people involved in the stock market has helped.

2I would tell my parents to do what they want and not worry about me. But good luck convincing someone to disadvantage their own kids.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.