Advertisement

|

|

QQA, RSPA, and EFAA aim to provide consistent monthly income and growth potential. |

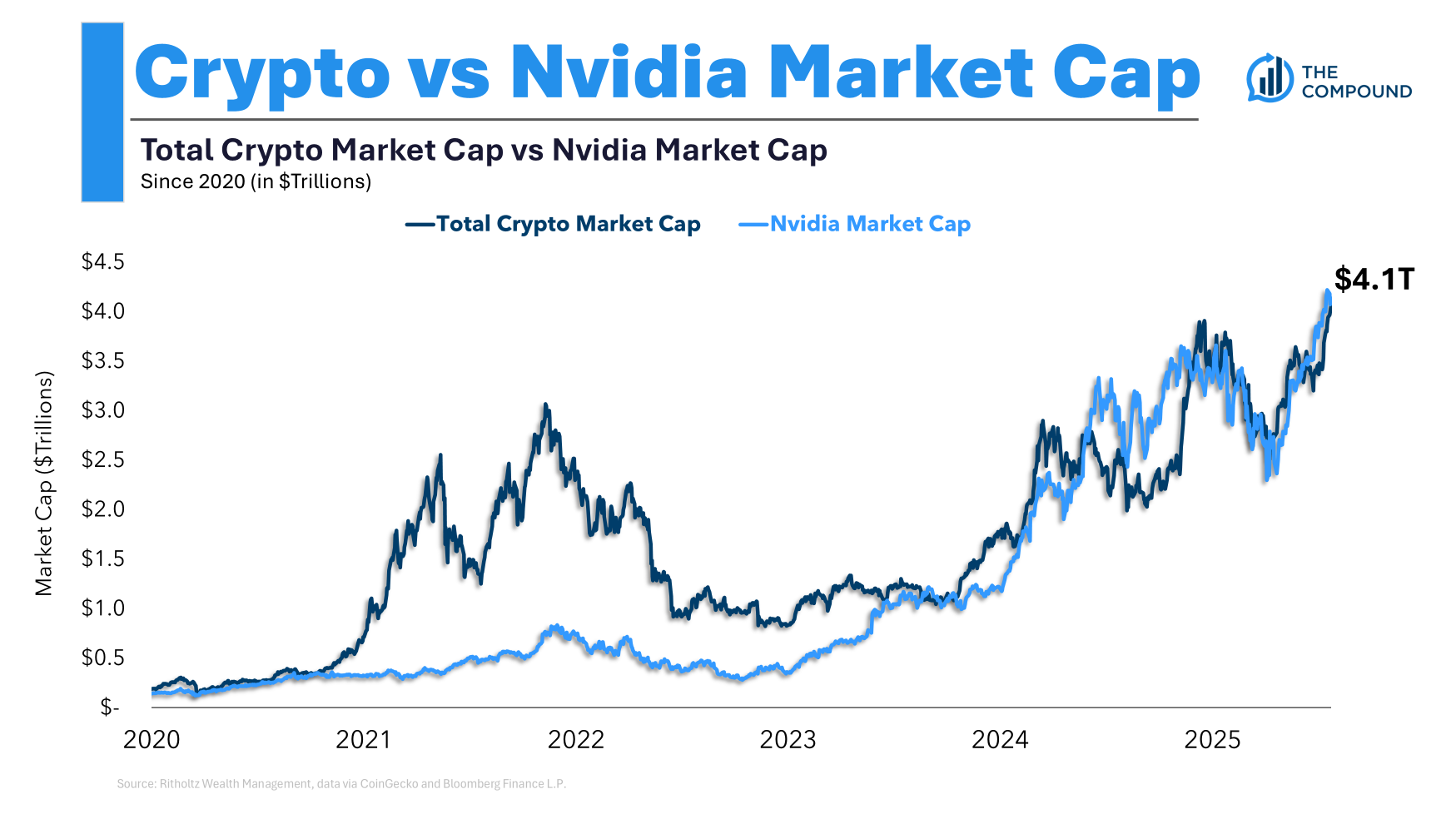

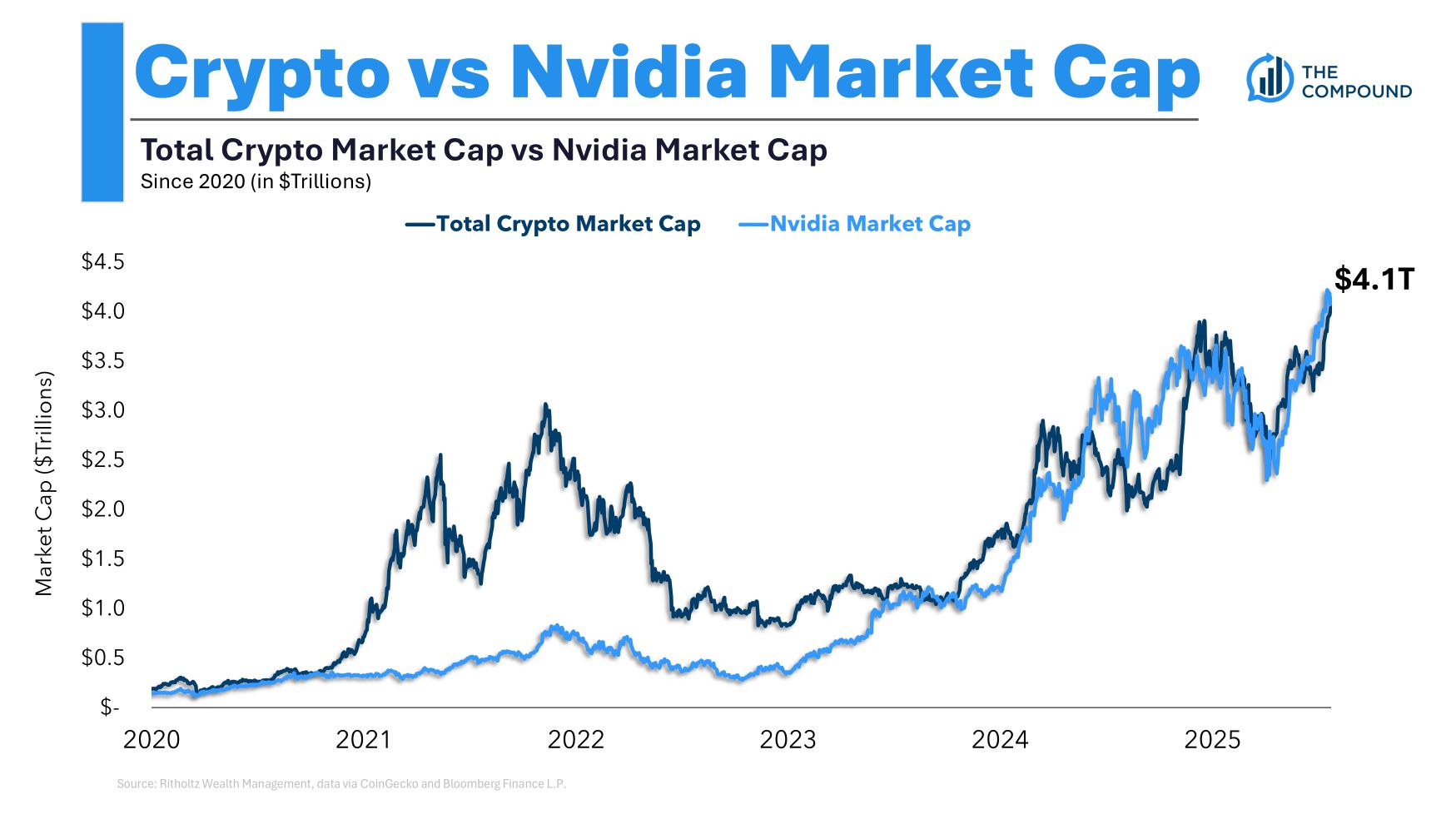

$4 trillion. That’s the size of the crypto market. It’s an astounding amount of dollars, and yet, when viewed through a certain lens, it’s really not that much.

If you’re a skeptic, you’ll dismiss this as delusional nonsense. I get it. But if you’re a believer, at least in number go up, like I am, you might think differently about how big this asset class can get.

I was aghast when JC made the comment last week that “It’s a rounding error. That’s really what it is.”

JC was making the point that it could go to zero, and it wouldn’t have any systemic implications. Here’s the clip, if you want to hear it from his mouth.

I was like, “WHAT ARE YOU TALKING ABOUT??? IT’S AS BIG AS NVIDIA!”

Except it isn’t as big as Nvidia. Nvidia has a market capitalization. Its price times its number of shares outstanding.

If “everybody” went to sell Nvidia, it would hit some sort of floor that is way higher than zero. Let’s not get bogged down in the “everybody” part, because for every buyer there is a seller etc etc, this is just a mental exercise.

My point is, at some number on its way down, a buyer would take the company private and feast off of its gushing cash flows. And if Nvidia decided it wanted to sell 100% of the company, there would be a buyer or a consortium of buyers that would be happy to take it off its hands. That’s what we mean by a market capitalization.

With Bitcoin, we took something from traditional finance and skeuomorphed it onto these tokens so that we could all make sense of its size. Except it isn’t a market cap at all. Because there is no single buyer or group of buyers that would take all of crypto off sellers’ hands. And if “everyone” went to sell, then there are no fundamental reasons why it couldn’t fall to $10.

And so when I say that $4 trillion is not a lot, or $2 trillion in the case of Bitcoin, it really isn’t. Because that number isn’t real.

But back to reality and not theoretical arguments. Right now, there is a race to buy Bitcoin. This chart from Bitwise shows that since the launch of ETPs, investors have purchased twice as many Bitcoins as Bitcoin that have been mined. Demand is outpacing supply by more than a little.

And this is corporate adoption. Again, there are way more buyers than sellers.

Who knows how long this dynamic lasts? At some point it will reach an equilibrium. And certainly, at some point, these dynamics will reverse and prices will come way down. I mean, duh.

I don’t know how high Bitcoin can go, or if I will look back on this post with shame, but it’s entirely possible that the ceiling is a lot higher than people think, especially if you’re thinking about the market cap.