Good Riddance: CalPERS’ Atrocious General Counsel Matt Jacobs to Retire

Why, pray tell, would the nation’s biggest public pension fund that also runs its own health insurance program hire a general counsel with no experience whatsoever in investment management, financial regulatory compliance, insurance, government public disclosure and other state agency requirements, and instead had been a private sector criminal defense attorney? Oh, and by credible rumor, one who was looking for a new gig because he wasn’t generating fees at the level that his law firm expected of partners? Hiring a crook-protector like Matt Jacobs as general counsel sure looked like a statement of CalPERS’ ‘intent to engage in less than savory conduct.

Shortly after she joined CalPERS as CEO, Marcie Frost asked to meet us for dinner. She reneged when she realized I intended to treat the discussion on the record. At the time, I told her she should fire Jacobs. The Matt Jacobs rap sheet below shows our recommendation to have been well warranted. These and many more posts document either his complicity in trying to cover up rather than correct CalPERS’ bad actions, or his direct role in dereliction of duty, above all in making sure CalPERS had adequate controls and procedures.

So we can take only a tiny bit of comfort from the fact that Matt Jacobs is retiring at the end of this month. It should have happened a long time ago.

Remember this is only a partial list. Take note of the range and significance of misconduct:

Board Member JJ Jelincic Calls Out CalPERS’ “Roy Cohn,” General Counsel Matt Jacobs

How CalPERS General Counsel Matt Jacobs Violated California Bar Rules

Corruption at CalPERS: General Counsel Matt Jacobs as Exemplar of Culture of Casual Lying

CalPERS Hired a Fiduciary Counsel Accused of Serious Misconduct Over More Than a Decade, Including Kickbacks, Failure to Disclose Conflicts of Interest

CalPERS, CalSTRS, Other Investors Have Indemnified Private Equity Criminal Conduct Even Though Fiduciary Counsels Say No

CalPERS Illegally Trying to Hide Its Scheming to Hand Over Private Equity to BlackRock

Dow Jones Sent Mother of All Nastygrams to CalPERS Over Its Massive Copyright Infringement; New York Times Called It Outrageous, Brazen, Possibly Unprecedented

“Heads Should Roll at CalPERS”: Who Should Be Held Accountable for Massive Copyright Infringement?

CalPERS Pays $3.4 Million to Dow Jones to Settle Massive Copyright Infringement That We Exposed

CalPERS Employee Accused of Embezzling $685,000 from Beneficiary Bank and CalPERS Accounts Hasn’t Been Arrested, Much the Less Prosecuted. Why the Cover Up?

CalPERS Self-Dealing: Board and Staff Grift at CalPERS Expense Via Grossly Underpriced Liability Waiver; Fiduciary Self-Insurance Policy “Invalid on Its Face” Due to Lack of Reserves

CalPERS’ Refusal to Put Clearly Insolvent Long-Term Care Insurance Plan in Bankruptcy Increases Harm to Policyholders and Makes Board and Responsible Executives Liable

Financial Times Publication Confirms Accuracy of Our Reporting on CalPERS CEO Marcie Frost’s Resume Misrepresentations; Board Refuses to Investigate and Instead Attacks Us

Cover-Up of CalPERS’ CEO Frost’s Misrepresentations of Her History: Document Destruction/Loss at CalPERS, Pressure on The Evergreen State College

CalPERS Laughingstock: Marcie Frost, Who Previously Pursued Non-Existent Dual Bachelors/Masters Degree, Designates Herself Law School Grad and Bar Member; Investment Committee Chair Theresa Taylor Admits Not Knowing What SPACs Are

CalPERS Chief Investment Officer Ben Meng Resigns Following Our Exposing His False, Felonious Financial Disclosure Filings and Private Equity Conflicts of Interest

CalPERS Out of Control: Stunningly High Number of Personal Trading Violations, Yet Board Ignored the Misconduct

CalPERS Uses Unqualified “Expert” to Validate Its London-Whale-Style Deficient Risk Management

More Railroading of CalPERS Board: General Counsel Withholds That Fiduciary Counsel Candidate Is Leading Case That Undermines CalPERS and CalSTRS

Criminality, CalPERS Style: Board Members Misappropriate Public Funds by Signing Blank, Undated Expense Forms

Robo-Signing, CalPERS-Style: Travel Expense Claim Forms Regularly Had Approval Signature of Board President Rob Feckner Faked by Staffers; Deputy CEO Doug Hoffner Also Participated in Approval of Undated, Pre-Signed Expense Forms

CalPERS General Counsel Matt Jacobs Violated “Zero Tolerance” Policy via Manhandling CEO Marcie Frost; Will CalPERS Sanction Jacobs or Change the Policy?

CalPERS Board Candidate Margaret Brown Objects to Unconstitutional, Non-Secret, Insecure, Unauditable Election; Vendor Handling Phone and Internet Voting Criticized for Incompetence, Exaggerating Security of On-Line Voting

Election-Rigging, CalPERS-Style: How Voting by Phone Was Designed to Favor Incumbent, Suppress Support for Challenger

CalPERS Can’t Even Figure Out How to Count Ballots in Accordance With Its Own Election Regulation, Let Alone Comply With California Law

CalPERS General Counsel Matt Jacobs Lies to Board, and Staff Abuses Authority, to Stymie Public Input

CalPERS Board, General Counsel Illegally Silence Naked Capitalism Even as We Try to Help

CalPERS Legal Department Employee Trolls Naked Capitalism Site, Putting Focus on Violations of Bar Rules

CalPERS Chief Investment Officer Ben Meng resigned effective Wednesday August 5. This was less than three days after we exposed Meng having made multiple felonious1 false statements on financial disclosure forms as well as holding investments in private equity firms when CalPERS was making multi-hundred-billion dollar commitments to them.2 Since Meng was seen in the office in routine internal meetings Wednesday morning, it appears his departure was not voluntary.

We were also first to break the story of his resignation, via Twitter; you can read the press release here:

We have from two sources that CalPERS CIO Ben Meng has submitted his resignation, presumably due to: https://t.co/mnfZHyd0eG

— Yves Smith (@yvessmith) August 6, 2020

This outcome was a self-inflicted wound. Remember that the Forms 700 that exposed Meng’s misconduct went first to CalPERS, which then sends them to the Fair Political Practices Commission. Apparently no one reviewed the documents, much the less suggested Meng correct them, even though CalPERS’ written policy is that the Form 700 is to be submitted in time so that the employee’s supervisor, which in Meng’s case was CEO Marcie Frost, can review it.

Apparently, no one checked the Form 700 against Meng’s trading records, which CalPERS should also have on file. Apparently, no one even told Meng to amend his form when CalPERS was about to post it on CalPERS’ site. And we will see when we get the results of our Public Records Act request, but it appears likely that CalPERS did not require Meng to recuse himself on private equity investment pitches from the firms whose stocks he held: Ares, Blackstone, and Carlyle….

CalPERS accelerated its decay when it chose a white-collar defense attorney, Matt Jacobs, as General Counsel in 2014. Despite having sworn an oath to defend the laws of California and having constitutional duties that make protecting beneficiaries paramount, Jacobs clearly sees his job as shielding the executive team. And that has included thwarting board members in making what at any well-functioning institution would be non-controversial inquiries, like getting senior management resignation letters, copies of procedure manuals, minutes of closed session board meetings, and internal audit reports.

Jacobs has repeatedly sullied CalPERS by regularly telling falsehoods in public, which is toxic model for an institution’s top compliance officer. The examples are too numerous to catalogue in full…

Needless to say, this conduct is deeply corrosive. It telegraphs to employees that something is deeply wrong. People whose job it to tell the truth think there is no payoff for doing the right thing, only punishment. This message has been powerfully reinforced by Frost and Meng forcing out some of the few remaining competent executives: Elisabeth Bourqui, apparently for questioning a “private equity new business model” that eventually died under the weight of its own contradictions, and then two highly regarded investment professionals, Ron Legnado and Paul Mouchakka.

Yet the CalPERS board, unwilling to look at its own culpability in this run of escalating scandals, chooses to blame commies under the bed, um, supposed pension haters. In fact, as we have catalogued, these transgressions were all unforced errors that merely adequate oversight would have prevented. There would be almost no bad stories about CalPERS if CalPERS didn’t keep generating them. Although CalPEERS has some competition from the disastrously underfunded and deeply corrupt Kentucky Retirement System, CalPERS under Marcie Frost has done more to damage the image of public pension funds in the US than any other force.

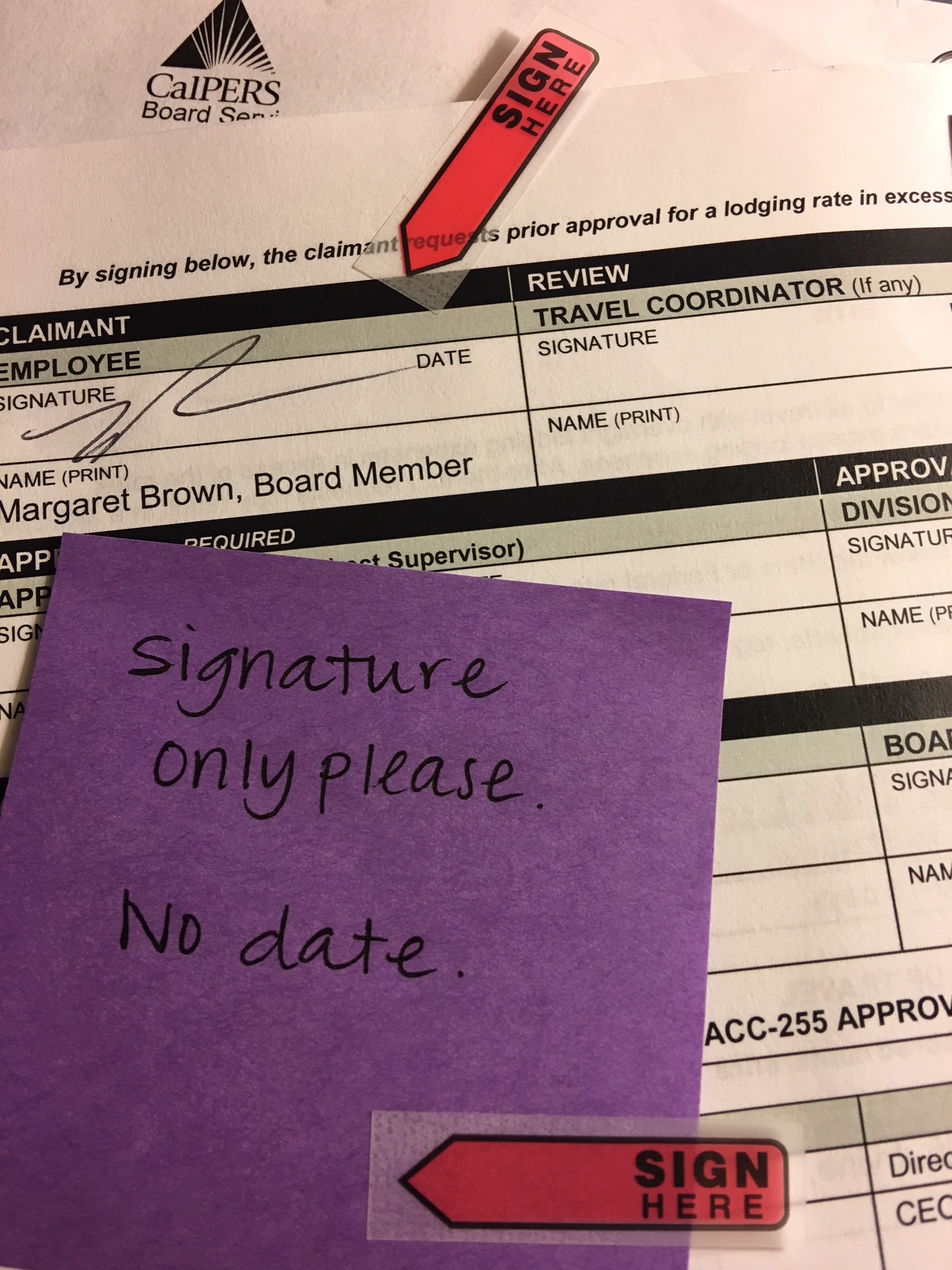

From Criminality, CalPERS Style: Board Members Misappropriate Public Funds by Signing Blank, Undated Expense Forms:

Pictures really can be worth a thousand words.

The images below and related evidence demonstrate conclusively that many, perhaps most, CalPERS board members have been filing fraudulent expense forms on a regular basis, some over a period of years. This is a written policy, codified in CalPERS’ board manual and is clearly intended to circumvent California state requirements.

The Board Services Unit, which reports to the Board President, asks board members to pre-sign blank sheets of paper with just a blank signature line printed on them. The Board Services Unit later prints onto that signed blank page the body of the travel claim form, with the dollar amounts and date filled in, and submits it on board members’ behalf.

Importantly, the form that CalPERS board members have been endorsing in blank requires the signature to certify a statement contained immediately above the signature that validates the accuracy of the information submitted on of the form. As you can see in one of the photos below, that certification is deliberately omitted from the nearly blank page that the board members sign in advance….

As Andrew Silton, former Chief Investment Officer for North Carolina, said by e-mail:

There’s a pretty simple rule in the realm of public pension management. You don’t sign blank signature pages whether it’s an investment management contract or an expenditure report. During my tenure as CIO for North Carolina we sometimes had to go to great lengths to get entire contracts and reports into the hands of the State Treasurer (the sole fiduciary) because he had to know what he was signing. Whether he was committing the pension to a multi-million dollar contract or requesting reimbursement for a few hundred dollars of travel expenses, he was drawing funds that belong to the pension trust. His signature, and at times my signature, had to be attached to completed documents.

Filling out expenditure reports was often a cumbersome task, and I needed help on numerous occasions to get the figures into the correct boxes on North Carolina’s expenditure form. So I suppose it would have been convenient to just sign a bunch of blank forms and dump a stack of receipts on someone’s desk. Aside from violating the law, this would have sent a terrible signal to staff and invited abuse.

Travel expenditures are a precious commodity in pension management. They allow fiduciaries and staff to perform proper due diligence. When abuses are unearthed (e.g. padding expense reports) public pensions tend to crack down. Not only is the abuse addressed, but legitimate travel is also curtailed.

The board of CalPERS shouldn’t need any training or lawyers to help them understand the importance of protecting the expenditure process. It’s amazing to me that all but a few board members at CalPERS seem to have no qualms about signing blank expenditure forms. Once again, it appears that senior staff rather than the board is in control at CalPERS…

On January 15, the day before Margaret Brown’s first day as a board member at CalPERS, she attended an orientation meeting with fellow incoming board member David Miller. Members of the Board Services Unit, all but one of whom are relatively low-level administrative staff, led the briefing. They gave Brown a raft of forms to sign and hand back to them. This is what she was given:

Brown signed them in front of staff before saying she wanted to look at them some more and took the folder with the signed copies with her. She did not return them….

Note that the certification language that sits right above the signature line has been omitted from the blank form Brown was asked to sign:

I HEREBY CERTIFY That the above is a true statement of the travel expenses incurred by me in accordance with DPA rules in the service of the State of California. If a privately owned vehicle was used, and if mileage rates exceed the minimum rate, I certify that the cost of operating the vehicle was equal to or greater than the rate claimed, and that I have met the requirements as prescribed by SAM Sections 0750, 0751, 0752, 0753 and 0754 pertaining to vehicle safety and seatbelt usage.

And it is no accident that Brown and Miller were asked to sign about 20 copies of each form. This is a page from the CalPERS Board Manual:

As the images show, the Board Services Unit instructs board members sign undated forms in blank, with the body of the form, including critically, the certification language removed.1 Staff prints the rest of the form, including the missing certification language, into the pre-signed document when they also fill in expense information and submit it on behalf of the board member…

The implication of the institutionalized practice of: 1) using pre-signed partial forms, 2) using them to fabricate documents that are falsely submitted as complete originals, and 3) using them as the basis for making of payment is that the current Board President, Priya Mathur, her predecessor, Rob Feckner, and members of the Board Services Unit have suborned board members to provide false certifications on an ongoing basis.

In addition, both the pre-signing of the travel claim forms and the submission of the false certifications is criminal conduct. Per Title 12 OF CRIMES AGAINST THE REVENUE AND PROPERTY OF THIS STATE, Section 424:

(a) Each officer of this state, or of any county, city, town, or district of this state, and every other person charged with the receipt, safekeeping, transfer, or disbursement of public moneys, who either:

3. Knowingly keeps any false account, or makes any false entry or erasure in any account of or relating to the same; or,

4. Fraudulently alters, falsifies, conceals, destroys, or obliterates any account;

Section 424(a)3 is colloquially called the “misappropriation of public funds” statute. Merely providing a “false account,” as in false certifications or doctored records, is a crime in and of itself.

In addition, Chapter 8 of the California Government Code makes conspiracy a crime, and defines it broadly in Section 182:

(a) If two or more persons conspire:

(1) To commit any crime.This means that not only have the “officers of the state” meaning Board Presidents Mathur and Feckner, along with any board members who pre-signed travel expense forms, apparently misappropriated public funds as defined under the law, but they and the members of the Board Services Unit who prepared and submitted the forms also look to have committed an additional felony, that of conspiracy.

Summarizing from this detailed post: Brown voiced her concern about this practice to a board member who was also an attorney, who confirmed that no one should ever sign a blank form. Matt Jacobs overheard the discussion, said it was improper and needed to stop, and said he would speak to Board President Priya Mathur about it.

Whatever Jacobs said to Mathur was apparently unserious. Rather than Mathur halting the practice and telling board members pronto that new procedures were to be implemented, Mathur scheduled a call with Brown. Brown e-mailed Mathur and told her about the practice and why she was concerned about it. Mathur replied by e-mail she would look into it and get back to Brown. As we described in the post, Brown did not hear back and there was no evidence any corrective action was taken at the time our post ran, months later.

So Jacobs couldn’t be bothered to pressure Mathur to fix something so obviously improper yet easy to remedy. This incident may help readers will understand the disgust with which I view his, Marcie Frost, and many other board members’ lazy, corrupt, and self-serving conduct.

And a favorite with some, CalPERS General Counsel Matt Jacobs Violated “Zero Tolerance” Policy via Manhandling CEO Marcie Frost; Will CalPERS Sanction Jacobs or Change the Policy?:

As much as we enjoy mining the seemingly bottomless vein of misconduct at CalPERS, we feel compelled to commemorate an incident from last week’s offsite because it so deeply offended the people who saw it live — many of them CalPERS beneficiaries who are retired after decades of honorable government service.

This incident, of General Counsel Matt Jacobs literally draping himself over CEO Marcie Frost’s shoulders for a long tete-a-tete, was a cut-and-dried violation of CalPERS’ Harassment, Discrimination, and Retaliation Prevention Policy. It epitomizes CalPERS’ hypocritical and two-faced posture toward board members and senior staff, by which members of the power faction are never held to account or even criticized. By contrast, those who are seeking to clean up CalPERS’ misconduct and incompetence are often severely sanctioned, in ways designed to interfere with the performance of their fiduciary duties.1

…Reports from a half dozen independent sources show that these witnesses were appalled. In fact, the degree of upset was what led one observer to take the pictures above, noting:

Matt ❤️ Marcie. CalPERS Santa Rosa off-site. I was a little slow with my camera, so I missed the minutes-long embrace from the other side — because I couldn’t believe that this was actually happening.

I was sitting with a woman from XXX and a woman from YYY who both attend SCORE. There was a third woman who I had just met that day who was a [former government job]. They were freaking-out.

It started looking like a casual huddle to whisper, but it lingered on-and-on to the point that the women were saying, “Somebody take a picture, this is completely inappropriate!” Jacobs had draped himself over both of Frost’s shoulders with his left arm, his hand casually cupping one of them. I couldn’t tell if it was a “power move” to dominate her or if there was some sort of creepy mutual cuddle-thing going on, because I couldn’t see their faces.

He’s huge and she’s tiny; which made the whole incident even creepier from the peanut gallery. Just a horrible “look” smack in front of a group of retired female shop-stewards. There’s also still a soupçon of salaciousness.

Other reactions, each from additional sources:

Audience Member 1: Attorney Mr Jacobs went to CEO Ms. Marcie Frost and proceeded to put his arm around her shoulders to have a private conversation, he then went to board President Mr. Jones and CEO Ms. Frost and repeated this act from the other side. During this interaction the previously mentioned board member [Theresa Taylor] glanced at this interaction and said nothing.

I found the interaction as unacceptable staff interaction and the non action of the board member as conflicting…Persons seated near me commented that the interaction appeared to be inappropriate contact between supervisor and subordinate.

Audience Member 2: His behavior was unsettling. I don’t know if he was being controlling or sexual towards little Marcie but it was unprofessional at best and sexual at worst.

Audience Member 3: It wasn’t appropriate For a staff member and his boss. It was sexual harassment.

Audience Member 4: It was gross. It looked like it could have been sexual but I doubt that. It reminded me more of a big dog we had. He’d put his paw on other dogs to show he was the boss.

It is noteworthy that most of the individuals above were older women. Generally speaking, older women grew up in an era where sexual banter and flirting in the workplace were seen as acceptable within bounds. The fact that women of this age group were deeply disturbed suggests that young women would have been even more upset. But as the last comment made explicit, they were disturbed by the power dynamic. By putting his hands on Frost and keeping them there, Jacobs was making a big and very public display of his dominance.

The State of California and many government bodies in the state trust CalPERS to handle their money, when most candy stores are better managed. While we can lay a lot of blame for the terrible controls, disregard for the law, and persistent preference for cover-ups rather than clean-ups, the buck ultimately stops with Governor Gavin Newsom. If he’s serious about a Presidential bid in 2028, it would behove him to shake up CalPERS lest some big creepie crawlies emerge during his campaign.