.bh__table_cell { padding: 5px; background-color: #FFFFFF; }

.bh__table_cell p { color: #2D2D2D; font-family: ‘Helvetica’,Arial,sans-serif !important; overflow-wrap: break-word; }

.bh__table_header { padding: 5px; background-color:#F1F1F1; }

.bh__table_header p { color: #2A2A2A; font-family:’Trebuchet MS’,’Lucida Grande’,Tahoma,sans-serif !important; overflow-wrap: break-word; }

Advertisement

Diversify Client Portfolios with CLOs

Collateralized Loan Obligations (CLOs) offer floating-rate exposure and portfolio diversification. Learn more about niche credit market interval fund strategies that seek to generate income and long-term capital appreciation at flatrockglobal.com/compound.Risk & Disclosure Information |

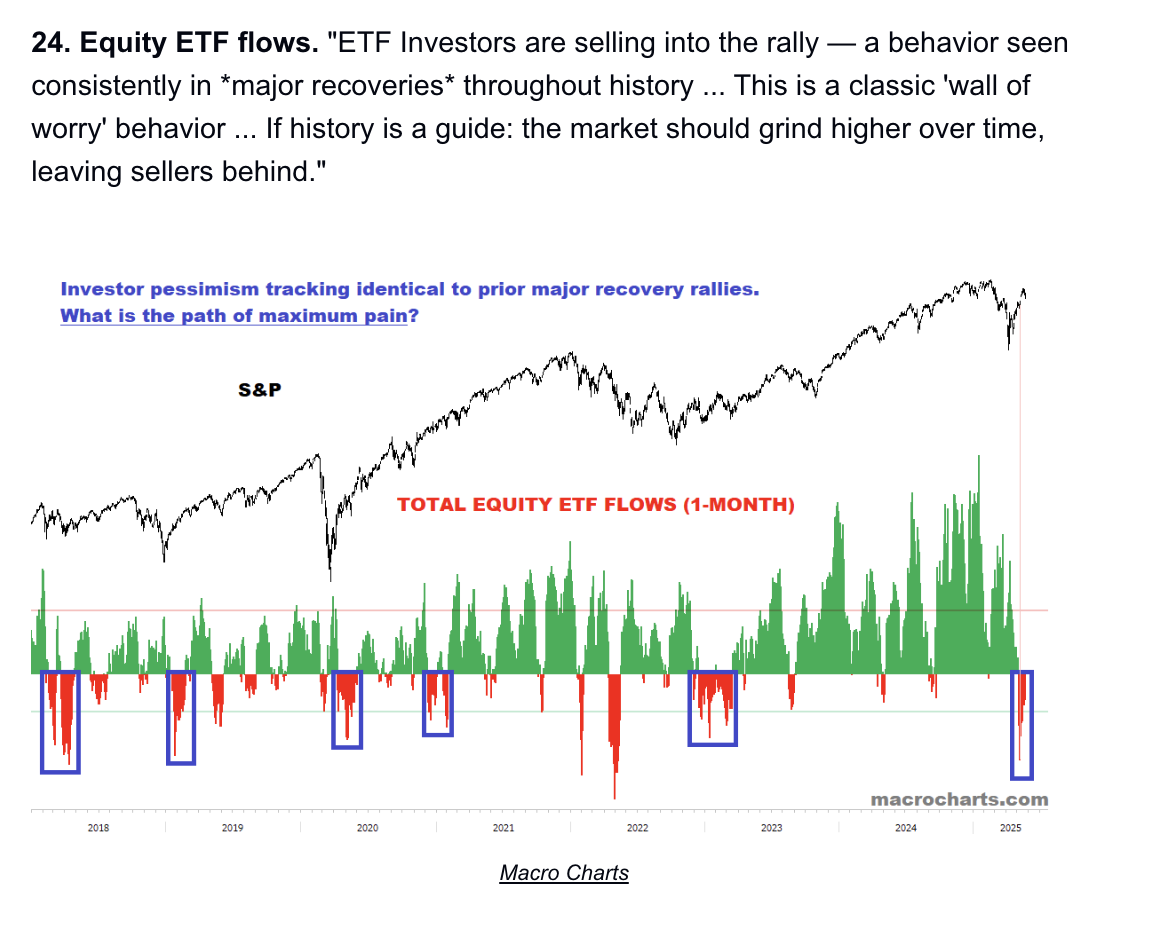

Ben and I discussed the notion that investors are more disciplined now than they used to be. Hard to say for sure, there’s always nuance in these sorts of debates, but I do believe there is at least some truth to this. In that vein, I came across something from Daily Chartbook that surprised the heck out of me.

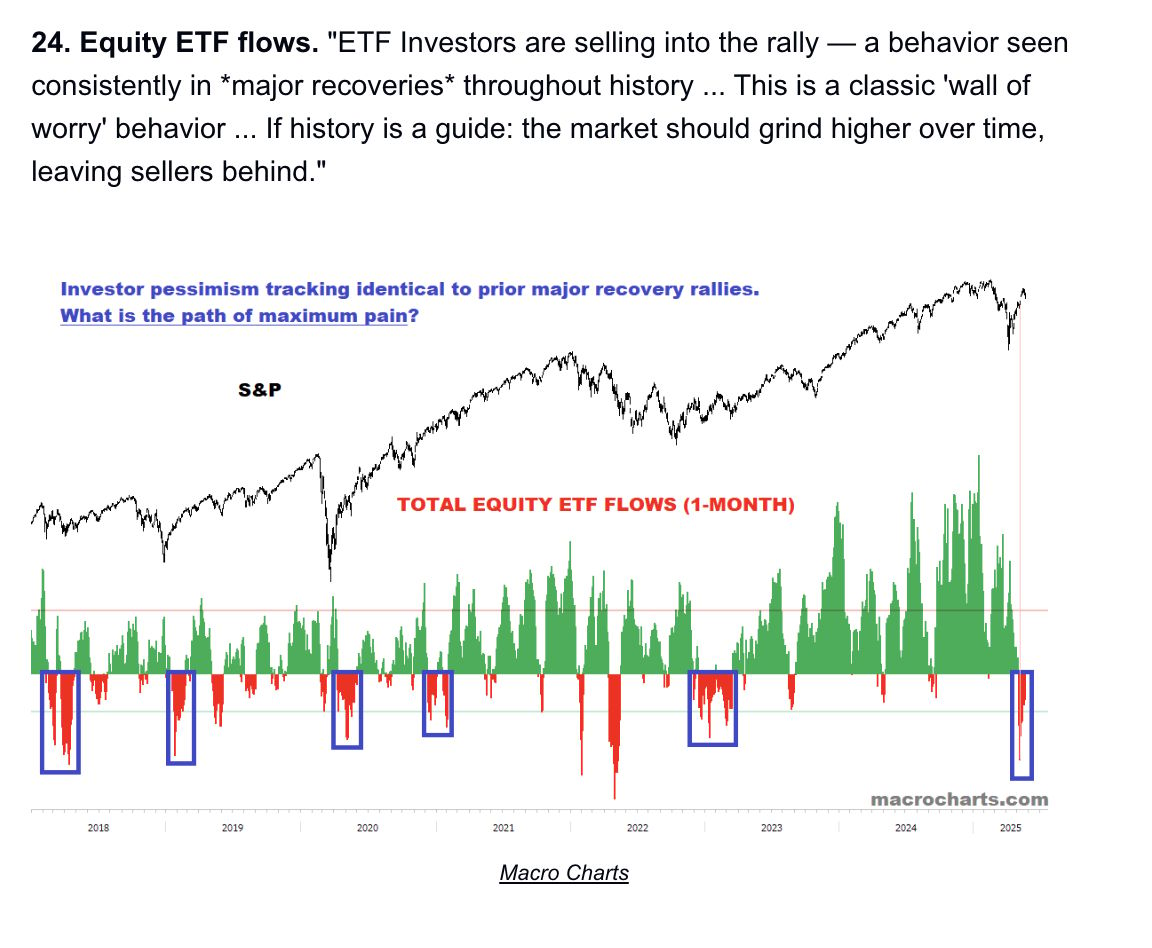

Investors bought the dip, but have been net sellers since the bottom. Todd Sohn told me that IVV, SPY, RSP, and IWM have all seen outflows since April 8th.

According to his work: ”At the start of the year, equity ETFs averaged roughly $3 Bn inflows per day (an extreme), whereas since the April 8th market low, the daily average is down to $1.4 Bn.”

So maybe these flows are just normalizing after a blistering hot start, or maybe investors are taking advantage of the rally to lighten up on some stuff they bought near the lows.

In other news, we had a new guest on The Compound and Friends this week that you’re going to love. His name is Jens Nordvig, and he's unlike anybody we’ve ever had on before. Hope everybody has a great weekend.