.bh__table_cell { padding: 5px; background-color: #FFFFFF; }

.bh__table_cell p { color: #2D2D2D; font-family: ‘Helvetica',Arial,sans-serif !important; overflow-wrap: break-word; }

.bh__table_header { padding: 5px; background-color:#F1F1F1; }

.bh__table_header p { color: #2A2A2A; font-family:'Trebuchet MS','Lucida Grande',Tahoma,sans-serif !important; overflow-wrap: break-word; }

Advertisement

Build Your RIA Your Way with Betterment Advisor Solutions

Betterment Advisor Solutions is the all-in-one custodial platform purpose-built for independent RIAs. Get the technology and support to serve more clients, more efficiently, across investing, retirement, and cash.Learn More |

The New York Knicks have a problem. Our two best players are both very poor defenders. It's hard, probably impossible, to win a championship this way. I'd have to look, but I'm pretty sure it's never happened.

The coach of the Knicks is legendarily stubborn. He's 67 years old and is pretty set in his ways. So it was amazing when he (finally) made an adjustment in game 3, and put in one of our better defenders to change things up. I'm not sure how much of a difference that particular move made, but the important thing is that we won the game. And with that move, and more specifically that win, the coach might have saved his job.

Had the outcome been different, the narrative would have been, “He panicked. The Knicks clearly should have won game 1, and we were right there in game 2. He choked, get him outta here.”

The outcomes shape the narratives, which brings us to today's markets.

The yield on long-term government bonds is as high as it's been since 2007. The stock market doesn't seem very bothered by it. Risk appetite is coming back as one of the governors of said appetite is being ignored. But is that really accurate? Do interest rates not matter?

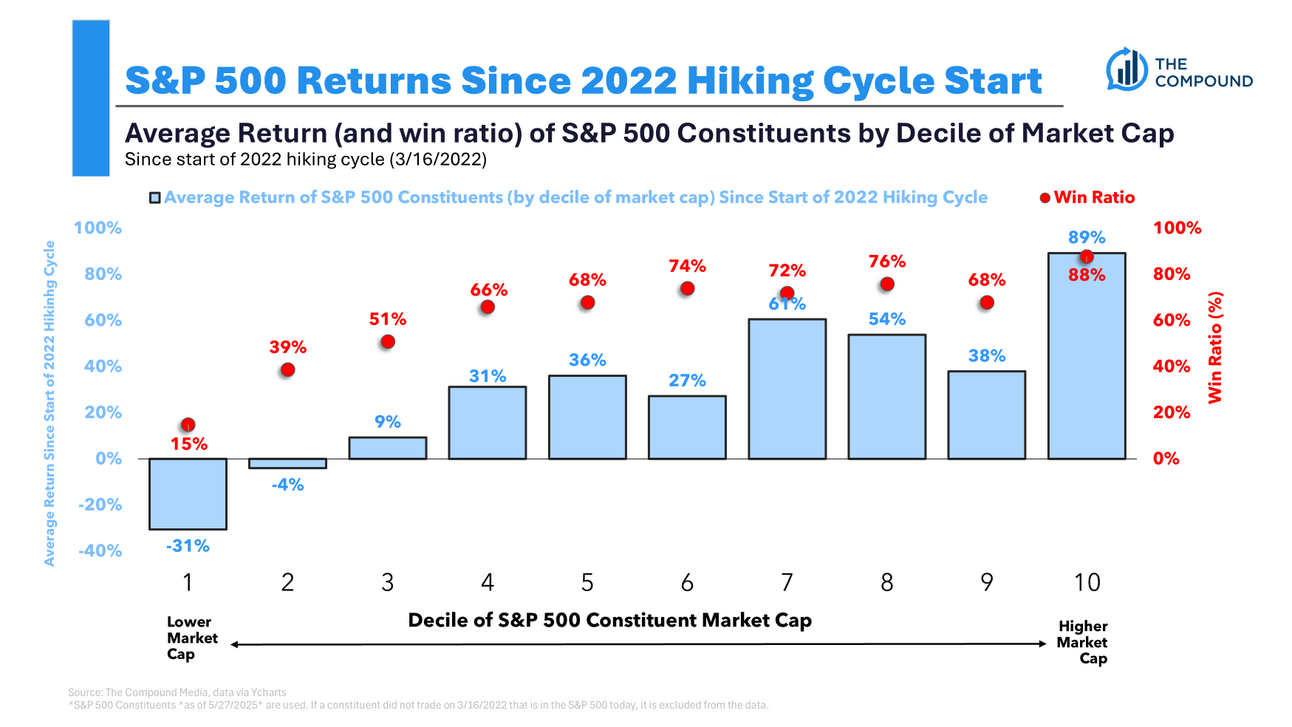

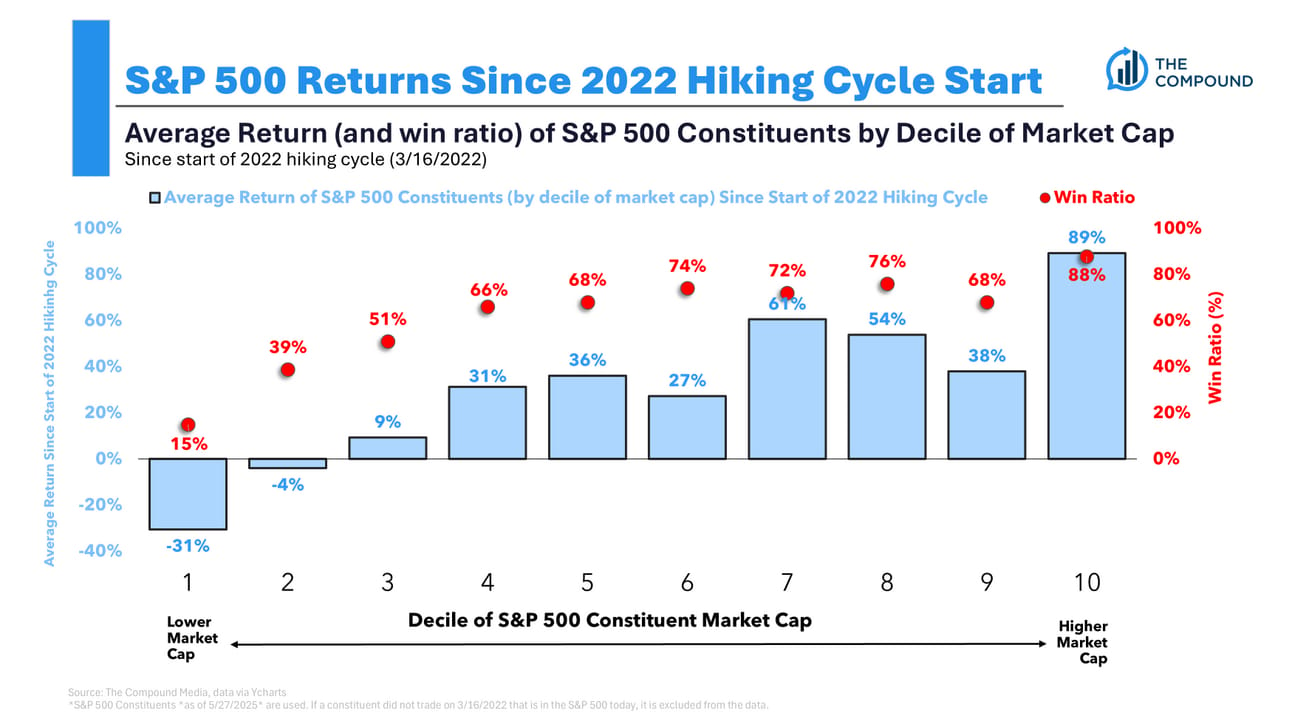

The S&P 500 might be near highs, but many smaller names that are more exposed to higher borrowing costs have taken it on the chin since the Fed started hiking. Only 15% of the smallest decile companies have a positive return since March 2022, with the average name down 31%.

Higher interest rates certainly matter to employees of large tech, as you can see in this chart from Torsten Slok. It's not a coincidence that they immediately chilled with hiring as the Fed started hiking.

High interest rates matter to venture capital investors. Look at the collapse in mega rounds since the Fed started hiking. Again, not a coincidence when this dropoff happened.

And finally, higher rates definitely matter to the housing market, especially existing homes, which are in an ice age.

It's easy to conclude that the cost of capital doesn't matter because the S&P 500 is near an all-time high. That would be losing the plot based on the outcome. I'm going to talk about why on tonight's What Are Your Thoughts, live at 5.