32 things to know about following…

The Simple Path to Wealth

(besides that it is not outdated) 😉

1. Investing, done well, is the soul of simplicity.

2. Anyone who tells you differently is selling you something.

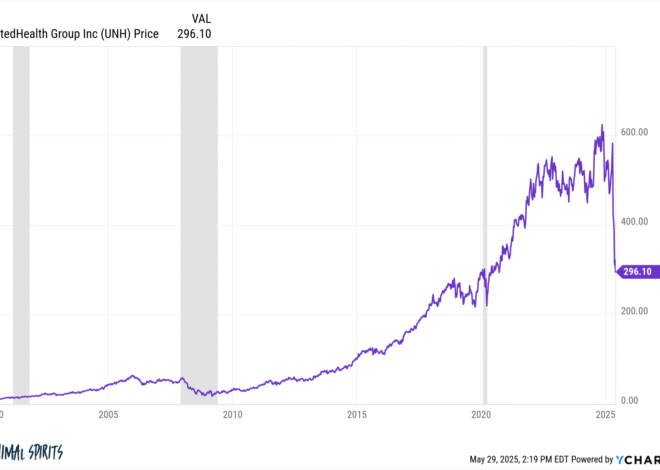

3. Investing is playing the long game: Think decades.

4. Once you understand a few key things, the less you think about it the better your results.

5. Once you implement those few key things, the less you do the better your results.

6. As Jack Bogle famously said, “Don’t just do something, stand there.”

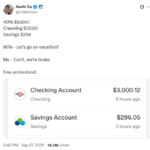

7. Automate your investments so the money invests without you having to think about it.

8. Ignore the market’s fluctuations.

9. There is never an ideal time to invest. Pundits will always say it is either too high and about to crash or it is already dropping and will continue to fall.

10. The market doesn’t need perfect conditions to go up. It goes up even with bad stuff happening all around.

11. Nobody knows what the market will do in the short term. As investors, we don’t care.

12. You can’t invest without risk.

13. Enduring the market’s volatility is the risk price you must pay for the market’s returns.

14. You cannot time the market and trying to do so is a fool’s game.

15. You cannot out perform the market over time. Trying will only cost you time, effort and money.

16. Low-cost, broad based index funds are the answer.

17. VTSAX is my personal choice. This is Vanguard’s Total Stock Market Index Fund.

18. VTI, the ETF version, is fine. It is the same portfolio.

19. A S&P 500 index fund or ETF is fine too. Vanguard’s are VFIAX and VOO.

20. Total Stock Market or S&P 500 index funds from other brokerage firms are fine too.

21. As an investor in The United States, I don’t feel the need to own international stocks. If you do, buy a world fund/ETF like VTWAX or VT.

22. The United States is the only country with a stock market large enough that you can own just that country’s market. If you live anywhere else, buy a world fund.

23. Most everything you hear about ‘investing’ in the media is really about speculation. Those of us on The Path are investors, not speculators.

24. You must stay the course when the market drops. If you are not absolutely sure you can do this, find another path.

25. If you panic and sell during drops, my advice will leave you bleeding by the side of the road.

26. When the storms come, tie your self to the mast. The siren songs of panic will be loud, strong and tempting.

27. Market corrections, bears and crashes are all a perfectly normal part of the process; and the market always recovers.

28. Resolve what you will do now, not when panic is all around you.

29. Building wealth takes time.

30. People who get rich quickly are ‘rarer than baptized rattlesnakes.’* Those few who do almost never manage to hang on to that wealth.

31. You are not alone. Many others have walked The Path before you. You’ll find ~100 of their stories here:

32. It is easier to invest as an optimist. If you believe the world, or the country, is on the verge of collapse, it will be very hard to stay the course. This is not the path for you.

If you are on The Simple Path to Wealth, what do you think people should know? Drop your thoughts in a comment below!

***************************************

*This is one of my favorite lines from Charles Frazier’s great novel Thirteen Moons. ***************************************

There has never been a better time to invest.

We live in the best, most prosperous, advanced and healthiest time in history. Something it is easy to miss with all the gloom and doom the media loves to broadcast.

Certainly there are problems and challenges yet to be resolved. There always are. But never in history have humans been better positioned to solve them.

These two books will help:

The Rational Optimist by Matt Ridley

***************************************